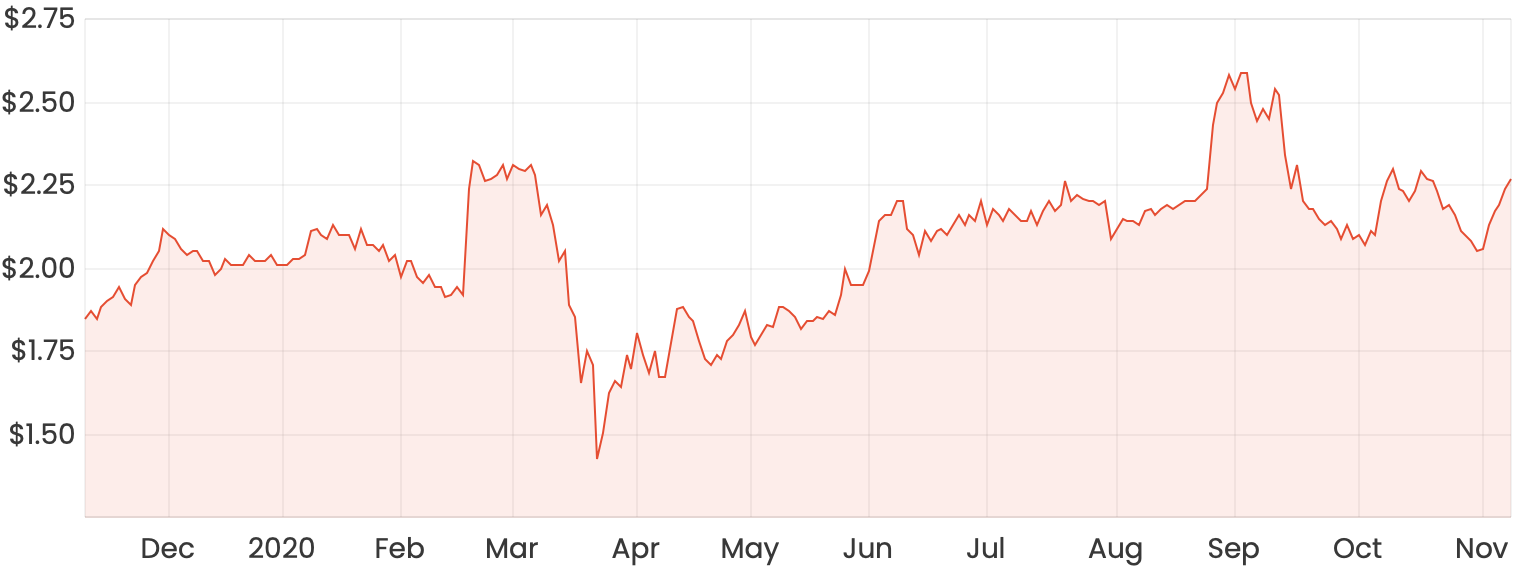

The Cleanaway Waste Management Ltd (ASX: CWY) share price has strongly recovered since its March lows and at the time of writing, sits slightly below its all-time highs at around $2.26 per share.

CWY share price chart

Here’s a quick analysis of the company and a few of my own thoughts.

What does Cleanaway do?

Cleanaway is Australia’s largest waste management company that services customers from small businesses to large multi-national commercial and industrial organisations across a range of different industries.

Its three core segments are solid waste services, liquids and health services, and industrial services. The company’s solid waste segment serves more than 100,000 commercial and industrial customers and over 95 municipal council customers.

Cleanaway generates revenue through the collection of waste, which is then processed through recycling facilities, waste transfer stations and highly engineered landfills.

Why has the Cleanaway share price pulled back recently?

Cleanway shares were trading at all-time highs in September at around $2.60 per share, but have since dropped around 13% to their current levels. This wasn’t the result of poor financial performance due to COVID-19, but rather internal corporate governance issues and exposed workplace practices that came into the public eye.

Cleanaway’s chief executive Vik Bansal was the subject of recent investigations which accused him of leading a “culture of bullying and harassment” that led to extremely high turnover rates of senior-level management and lower-level employees.

Although this is undoubtedly a bad look for the company, this wouldn’t be the sole reason I would hit the sell button for Cleanaway shares just yet. But, when you look at past earnings growth and the valuation that comes along with these shares, it seems hard to argue for a bargain in my opinion.

On a per-share basis, earnings haven’t moved for the last three years despite the company achieving revenue growth on a yearly basis. Cleanaway typically achieves a return on equity of around 5%, so it’s hard to see how as an investor in the secondary market, you can somehow achieve a greater return than the business can on the capital that’s been contributed by equity investors initially.

Cleanaway’s valuation seems stretched on its current price-earnings ratio of 36x FY20 earnings. High P/E ratios can be justified if there’s a high level of growth anticipated, but it’s hard to get excited based on past results.

Cleanaway shares: buy/hold/sell?

I’m sitting this one out for now for a couple of reasons. Firstly, I’d be wanting to wait and see if the company can resolve its governance issues before hitting the buy button.

Secondly, I think there are other ASX shares with better growth prospects which have valuations that aren’t as stretched as Cleanaway.

Right now, I’m liking Baby Bunting Group Ltd (ASX: BBN) shares, which I recently wrote about here.