The Treasury Wine Estates Limited

(ASX: TWE) share price is down heavily over the last year. It’s probably worth asking: is it time to consider buying shares?

Treasury Wine Estates (TWE) is one of the world’s largest wine companies. TWE’s wines are sold in over 70 countries, with Penfolds perhaps its most prestigious brand.

Why has the TWE share price been sold off?

TWE also had a tough FY20 with COVID-19 impacts causing Volume and Net Sales Revenue (NSR) to dip 1.9% and 1.7%, respectively. TWE’s CEO Tim Ford

cited, “lower luxury sales due to the closure of key channels for high-margin luxury wine in addition to consumers trading down in some markets”.

On 18 August, TWE advised the market that the Chinese Ministry of Commerce had opened an anti-dumping investigation into Australian wine producers. TWE Chairman Paul Rayner said, “this decision matters deeply to our business and the industry, both in Australia and China”.

The Export Council of Australia

defines anti-dumping as when: “

an exporter sells a product to a country at a price that is less than its home market price for the same product, or below-cost, and the price of the product causes injury to the that country’s industry that makes the same kind of product, then the Country’s government may impose a special customs duty (“anti-dumping measures”) to equalise the price with the exporter’s home market price or full product cost, whichever is higher”.

Wine supply & demand

TWE’s management said that an oversupply of Californian wine was a source of challenge throughout FY20. Global wine production fell 11.5% in 2019 due to unfavourable weather conditions in Italy, France and Spain.

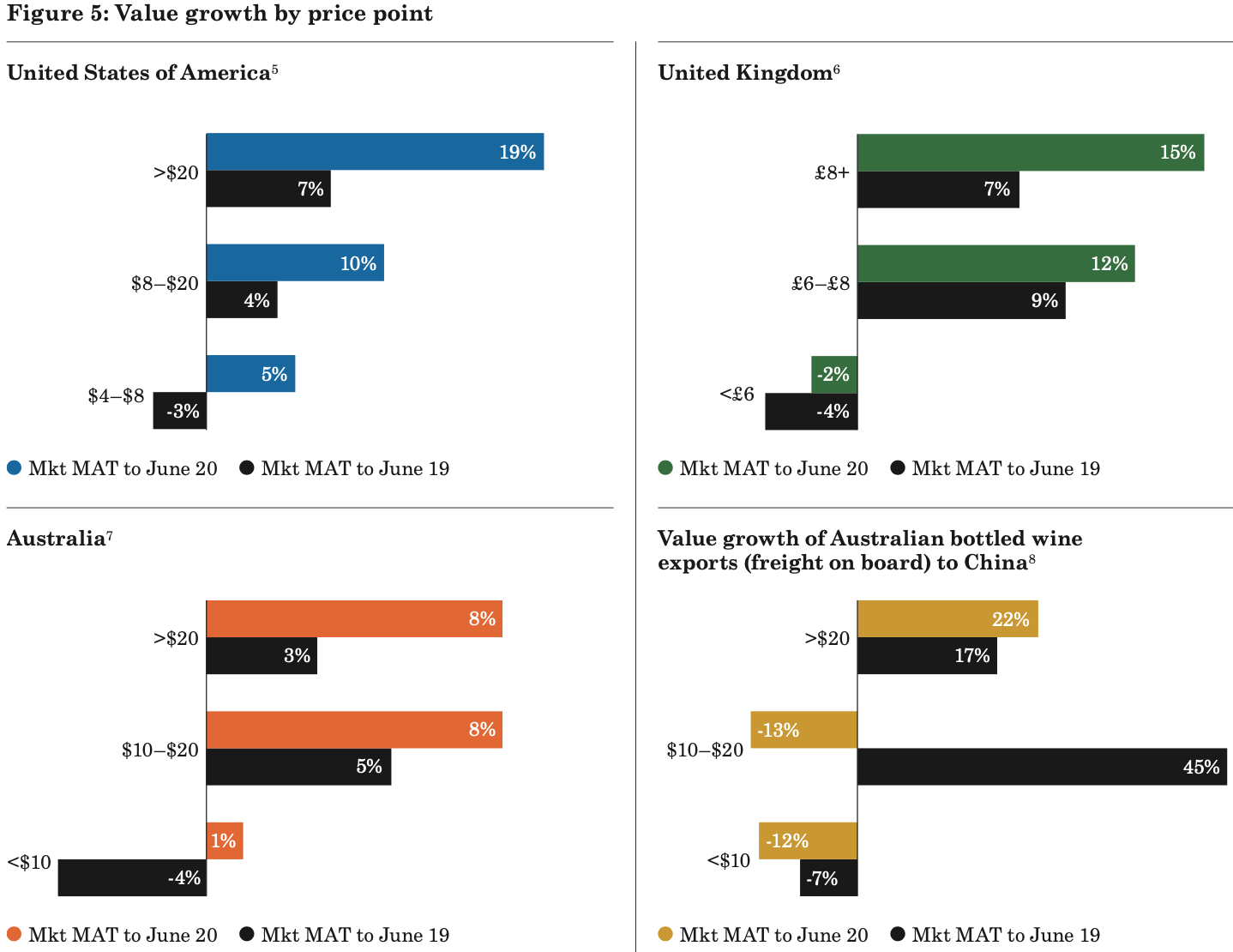

From a longer-term perspective, however, TWE expects consumer demand for wine at the higher ‘masstige’ (i.e. mass-produced, inexpensive wines sold as luxury products), as well as luxury price points in which it specialises, to remain strong as illustrated below. According to TWE, Masstige wines have a shelf price of $10-$20 AUD and Luxury wines are above $20.

Possible demerger of Penfolds

TWE is currently considering demerging the Penfolds brand and business. The company expects it will create value by allowing Penfolds and TWE’s other brands to focus on, “long term growth and value creation”.

The process is expected to continue into 2021, which may result in Penfolds becoming a separately-listed entity on the ASX.

Is it time to stock up on TWE shares?

I believe the anti-dumping probe and impact of COVID-19 on TWE are not permanent and as a result, long-term focused investors are being offered an opportunity to stock-up on TWE shares. The supply/demand outlook looks positive and a demerger of Penfolds could be a bonus for shareholders. The yield of 3.1% in the current low rate environment is also another positive.

Don’t forget, Rask Media has a daily source of ASX dividend shares for your watchlist — bookmark our webpage for daily stock ideas.