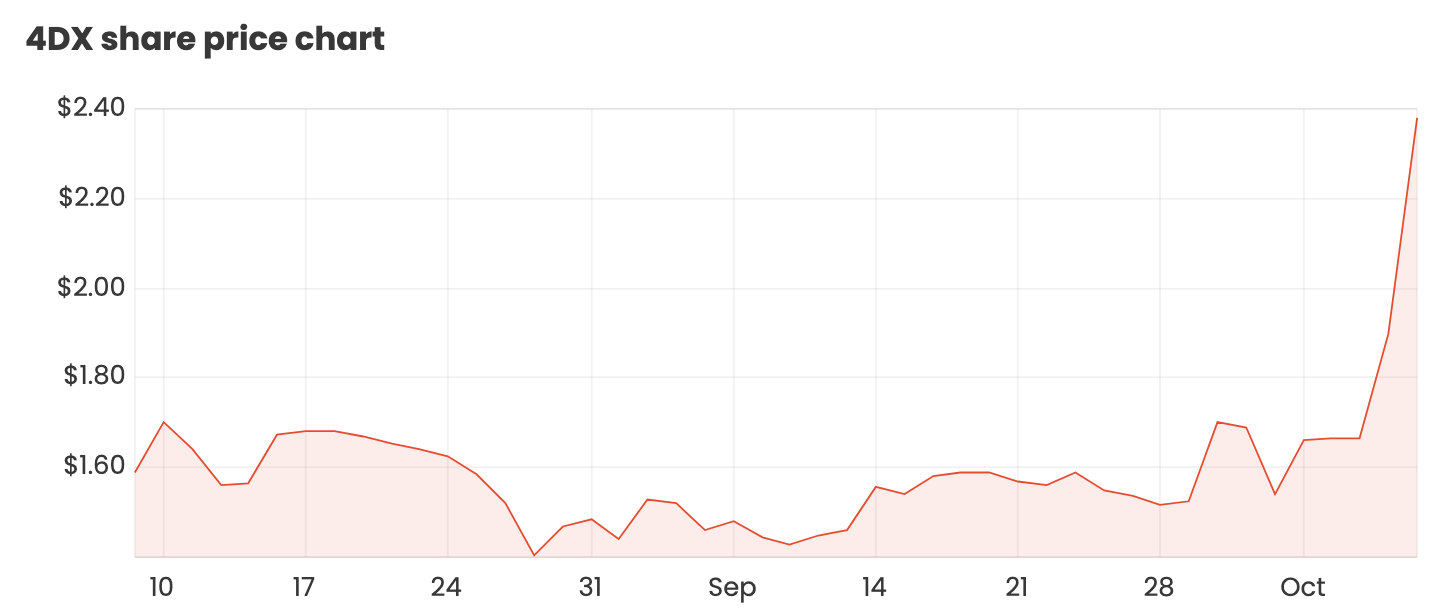

The 4DMedical Limited (ASX: 4DX) share price is up over 47% off the back of some recent positive announcements in recent times. Is it too late to buy 4DX shares?

What does 4D Medical do?

4DMedical is a health technology SaaS business that operates in both Australia and the US. The company’s proprietary XV technology works by converting sequences of X-ray images into four-dimensional quantitative data by using patented mathematical models and algorithms.

Those words don’t make a lot of sense to me, but the technology aims to improve patient experiences and outcomes by allowing doctors to make better-informed decisions with earlier intervention.

What I like about this company

The area of medical technology is exciting and solves important issues that will help the quality of people’s lives. From this point alone, it would be great to see this company succeed and commercialise its product. 4D’s diagnostics aims to replace old technology such as X-ray and CT scans, which according to 4D are out-of-date and not fit for purpose anymore.

No initial capital expenditure is required by hospitals that wish to use 4D’s products due to the initial software integration being paid upfront by 4D. Hospitals can still use their existing imaging hardware and software, but 4D is able to integrate its technology into these older systems.

An attractive feature of 4D is the payment model. 4D charges a fee on a “per scan” basis, charging US$175 per test using the XV technology. The capital-light sales model that leverages existing infrastructure hopes to deliver a 90% gross margin.

Some concerns I hold

Like many other companies in medical technology, the initial research and approval stage is only one element of the overall business lifecycle. The XV product still needs to be commercialised on a large scale and distributed through a sales team. 4D states that it already has established relationships and plans to leverage this, but this is easier said than done.

I compare 4D Medical to Alcidion Group Ltd (ASX: ALC) which is also a SaaS provider in health monitoring. Alcidion also offers a fantastic product that solves real problems but is at the mercy of often underfunded hospitals using other alternatives on long-term contracts. 4D could be different, but it may not shoot the lights out in the short-term.

Taking a brief look at 4D’s financials, the company is still running at a loss due to it going through an approval/growth stage. This makes the valuation tricky as you can’t run a discounted cash flow model if you were to use this method.

It’s too early for management to provide any sort of earnings estimates or guidance, so using any sort of multiple is also out of the question.

At this point, it’s really just the market attributing a value that is purely based on big expectations. Only time will tell if future cash flows can justify the current share price.

Final thoughts

I would personally like to see at least a short length of demonstrated profitability, as I do notice AUD$17 million in borrowings on the balance sheet. Right now, I’d prefer a company with a longer track record such as Catapult Group International Ltd (ASX: CAT)

I also highly recommend that you watch this podcast with Rask Australia founder and analyst, Owen Raszkiewicz, and Strawman founder and investor, Andrew Page, if you’d like some further insight into Catapult.