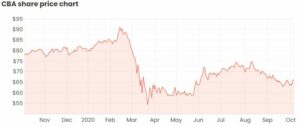

Commonwealth Bank of Australia (ASX: CBA) was one of the most-traded ASX shares on CommSec last week.

This came following the decision to scrap responsible lending laws previously enforced by the Australian Securities and Investments Commission (ASIC).

CBA shares rallied by over 4% following the announcement and trade at $66.60 at the time of writing.

The market has perceived this announcement to be good news. Logically, banks should be able to make more loans and collect more interest with less stringent lending laws.

Here’s just one way I compare CBA with a company like Xero Limited (ASX: XRO).

Banks typically underperform in low-interest-rate environments

Counterintuitive isn’t it? Logically, it would seem that if a bank has to pay its depositors less with a decrease in interest rates, then this would be a win for the bank. The opposite is in fact true.

Think about how much interest you receive on your typical transaction account. A large portion of deposits that banks hold are non-interest bearing, so they pay next to nothing to hold your cash as a deposit.

As interest rates decrease further, the interest rate paid on deposits can’t get much closer to 0%. But because the interest rate on a bank’s revenue-generating assets such as loans will decrease, this will compress its net interest margin as interest rates continue to drop and cut into the bank’s profitability.

COVID-19 has seen governments and central banks take measures to stimulate the economy and encourage lending activity. A record-low cash rate will most likely remain where it is for a while, so banks will continue to face a significant headwind in the short to medium term.

Why I prefer Xero’s cost structure

Xero, on the other hand, isn’t faced with the cyclical nature of interest rate fluctuations. This isn’t to say that there are no risks inherent in Xero’s operations. I just prefer a stock that’s profitability isn’t contingent on long-term macroeconomic indicators, such as inflation and GDP growth, that require changes to the cash rate target.

Xero is a provider of cloud-based accounting software that already has a large presence in Australia, with operations currently growing in the UK and the US.

The company has already written the code and doesn’t have to write it again every time a new customer wants to use its platform. Of course, money is spent on the development of Xero’s platform, but this operating leverage allows margins to expand as it grows sales, rather than a contracting margin that banks will face in a low-interest-rate environment.

Final thoughts

I’m not afraid to say that ASX banks are in the too hard basket for me. There are too many moving parts and too much contingency on other events.

If you’ve got the choice between putting your money into a sector facing a significant headwind in the short to medium term or an area with a much more appealing cost structure and international growth potential, the choice is a no-brainer to me.

Click here to read my in-depth article on Xero about why it’s one of my current favourites on the ASX.