The Betashares Global Sustainability Leaders ETF (ASX: ETHI) launched in January 2017 and has become one of the fastest-growing ASX ETFs since.

Here are two reasons I like the ETHI ETF – and one reason I don’t.

A quick overview

ETHI is one of Betashares’ four “ethical” ETFs, investing in a portfolio of companies identified as “climate leaders” that have also passed screens to exclude companies with significant exposure to fossil fuels and other “unethical” industries.

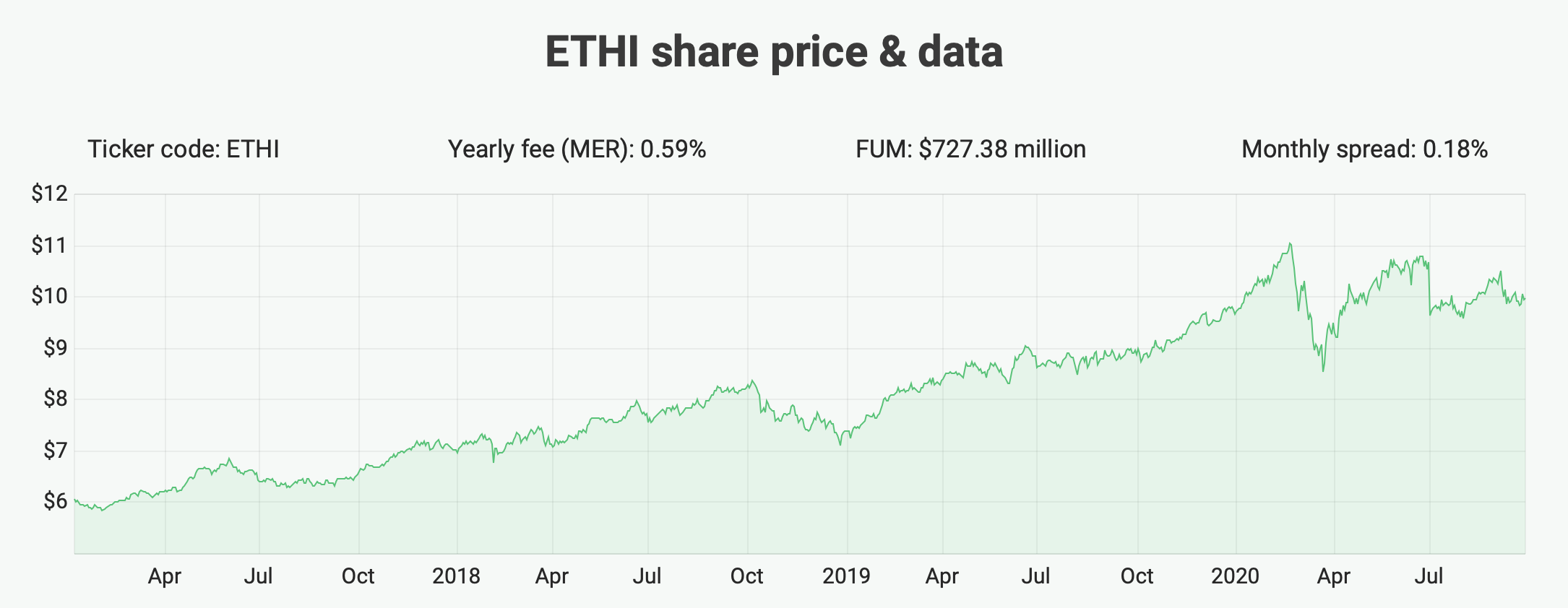

ETHI takes an annual management fee of 0.59% per year, pays semi-annual dividends, and has returned 21.57% per year since inception in January 2017.

Global exposure

The first appealing feature of this ETF to me is global exposure. ETHI’s global focus allows it to invest in some of the global giants like Apple Inc (NASDAQ: AAPL), Tesla Inc (NASDAQ: TSLA) and Netflix Inc (NASDAQ: NFLX), which have all been big contributors to the growth of the fund.

While a large portion of the ETF’s assets is US-based (around 70%), ETHI also provides exposure to companies based in Japan, Switzerland, the Netherlands, Hong Kong, France and others.

Typically when I’m looking at ETFs to invest in, I favour global exposure as it broadens the scope of possible investments and moves away from the largest ASX-listed companies which are heavily skewed towards mining and financials.

Global exposure allows an ETF to achieve better diversification and opens up the possibility of investing in the best companies in the world, rather than the best companies in your domestic market.

Global investing does however come with some increased risk, introducing factors such as exchange rate risk and exposure to global political and economic risk. Global exposure is also generally associated with higher management costs.

Sustainable focus

The second reason I like the ETHI ETF is of course the sustainable focus. When selecting investments, BetaShares starts by picking companies from developed markets which meet its usual market cap and liquidity requirements.

From there, the ethical screening tests start. Companies in the ETHI portfolio must be in the top one-third of performers in their industry in terms of carbon efficiency. There are no fossil fuel producers, no companies with significant involvement in gambling, alcohol, junk food, or armaments, and there are no companies lacking gender diversity at the board level or with known human rights or supply chain issues.

This approach of using some positive screening and some negative screening goes a long way to ensuring that the companies ETHI invests in could be broadly categorised as “ethical” and has clearly not harmed performance over the last three years.

But what does “ethical” really mean?

You may have noticed that throughout this piece I’ve used the terms “ethical” and “unethical” in quotation marks, which leads me to the reason I don’t love ethical ETFs. Ethics are inherently subjective; no two people will always agree on what is ethical and what isn’t.

This is not necessarily a criticism of ETHI or BetaShares, but more of the idea of an ethical ETF in the first place. I’m pleased to see what ETHI is trying to achieve and it seems like their screening criteria does a good job of excluding the most controversial companies, but I think it’s difficult to create an ETF that uses a few screening criteria to find a portfolio that everyone can agree is ethical.

As a broad solution for ethical investing these ETFs certainly have merit, but personally, if I’m looking to invest ethically I’m searching for individual companies that do good for the world, rather than not doing bad for the world. It’s a subtle but important difference that I’m not convinced has been captured by this or other ethical ASX ETFs.

To read more about the BetaShares Global Sustainability Leaders ETF, check out our free ETHI report.