Ever been dumbfounded at the checkout as you continue to press your card against the top of the EFTPOS terminal to no avail?

Then the cashier politely asks you to tap your card on the side of the machine.

Yep, that’s likely a Tyro Payments Ltd (ASX: TYR) merchant.

Who is Tyro Payments?

Tyro is Australia’s fifth largest merchant acquiring bank by terminal count, behind the four major banks.

It doesn’t own the EFTPOS terminals, rather providing the payment infrastructure and merchant platform for small and medium enterprises (SMEs) to scale their business.

The company differentiates itself from competitors by providing technology-focused payment solutions to 32,000 Australian merchants.

Over half of the employees at Tyro are in technology roles.

Tyro has recently broadened its product offering by becoming the first Australian bank to offer least-cost routing and an integrated Alipay solution, in addition to providing eligible merchants cash advances.

Trading updates

Tyro has shared weekly transaction data since 25 March to increase transparency around the impact of COVID-19 on its operations.

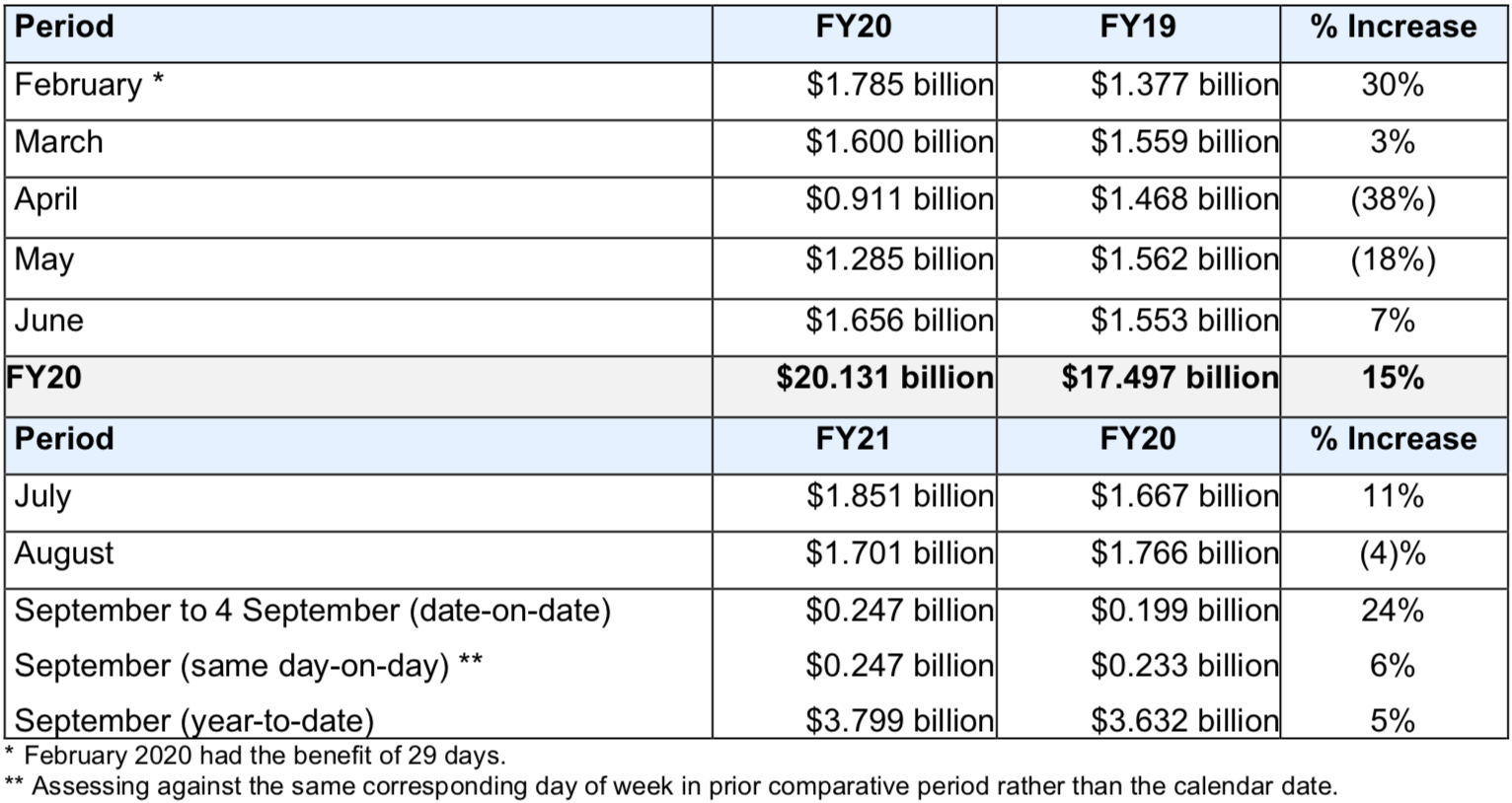

Each Monday, Tyro releases weekly trading updates, which details transaction value data benchmarked against the previous year’s performance. Below is the latest release:

For the month of September, the company recorded a 24% increase in transaction volume relative to last year. However, when comparing like-for-like trading days, volumes increased just 6%.

Year-to-date volumes are up 5% year-on-year, a significant decrease in what investors have become accustomed too. Before the impact of COVID-19, transaction volumes were growing at circa 30%.

In Tyro’s latest annual report, Chair David Thodey voiced FY20 has been a “very challenging year, particularly for merchants with the impact of COVID-19 and the bushfires wreaking havoc on their businesses and ambitions”.

Why are the trading updates useful?

For shareholders or potential investors, the updates provide a unique amount of transparency around the underlying performance of Tyro and its merchants.

I believe one strength of a strong business is the willingness to regularly and openly engage with shareholders, irrespective of whether the news is positive or negative.

Even if you are not invested in Tyro the company, the trading updates provide a robust primary source of information when analysing the overall economic environment, especially for companies leveraged to the SME segment.

This information may be useful for analysing companies such as market darling Xero Limited (ASX: XRO), beverage producer Coca-Cola Amatil Ltd (ASX: CCL), or job advertiser Seek Limited (ASX: SEK).

Regardless of your interest in Tyro, this company is worth adding to your watchlist for its weekly trading updates.