VanEck’s Russel Chesler dives into the recent gold rush as a global resurgence in coronavirus infections and the reintroduction of lockdowns has seen even more investors flock to the relative safety of the precious yellow metal.

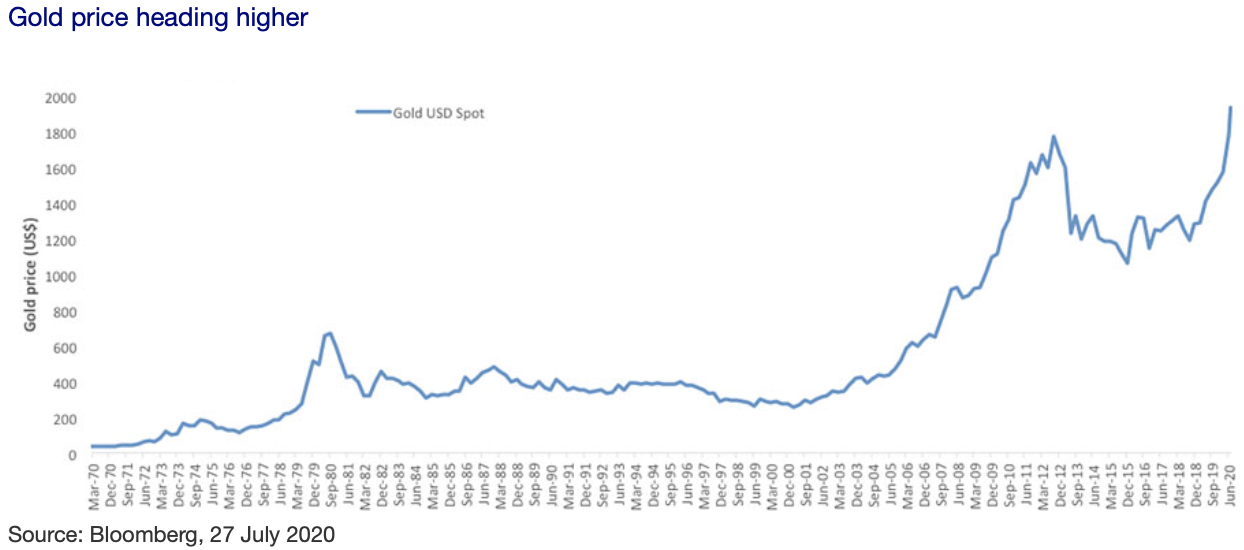

The gold price jumped over US$1,900 in July, its highest since September 2011. Bullion’s quick move higher last month comes as the US dollar slides against all major currencies and amid negative real rates in the US given the huge size of the US Fed’s stimulus program and government spending.

A global resurgence in coronavirus infections and the reintroduction of lockdowns has reminded investors that a global economic recovery remains far off, forcing even more capital into the relative safety of gold and gold stocks, which provide valuable portfolio diversification.

The scenario of ongoing low interest rates will help to sustain the gold price well into the future. Historically low bond yields and negative real interest rates have helped to push gold higher. When real rates are negative, investors aren’t getting any return at their cash deposits, so gold becomes competitive with interest-bearing assets.

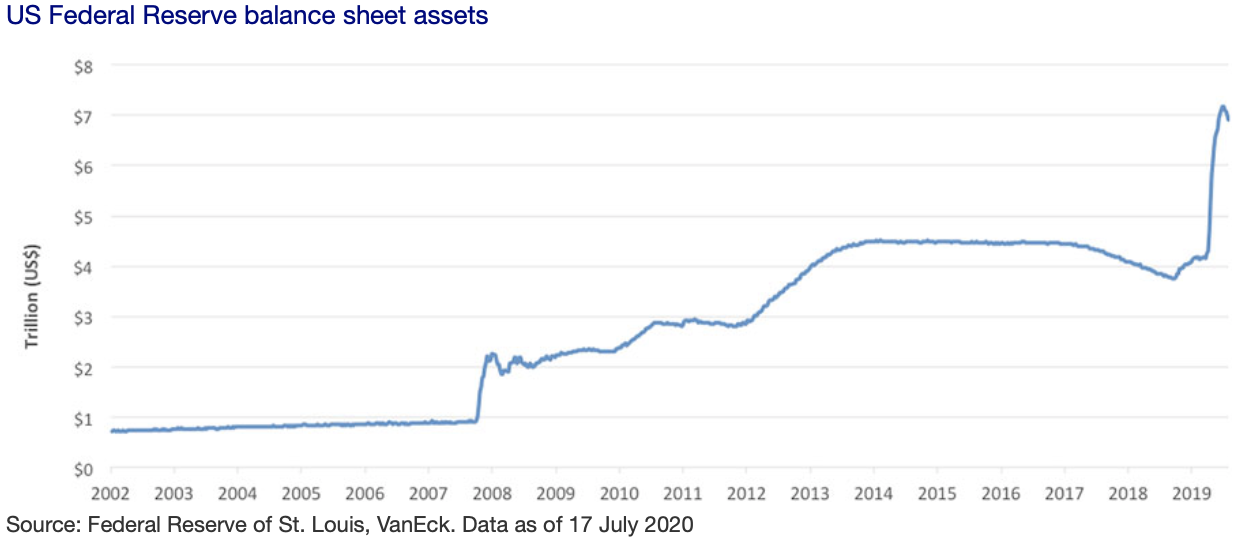

US Fed’s balance sheet is exploding

The US Federal Reserve and other central banks in developed countries have responded to the COVID-19 crisis with alarming altruism, pumping up economies to limit the risks of a prolonged recession.

Looking at the chart below, you can see the vertical rise of the blue line over the past few months. During the 2007-08 financial crisis and subsequent recession, total Fed assets jumped to US$4.5 trillion in early 2015.

Beginning in September 2019, total assets have skyrocketed to around US$7 trillion currently from just over US$4 trillion in March 2020. The expansion of Federal Reserve assets as an aggressive response to the COVID-19 crisis has been matched by an expansion of the Federal Reserve’s liabilities, which must eventually be repaid.

As the US government’s debt has exploded to around 40% of GDP, and real interest rates have dived below zero, analysts have been revising up their forecasts for the gold price, with some predicting it will go as high as US$2,200 to US$2,300 next year.

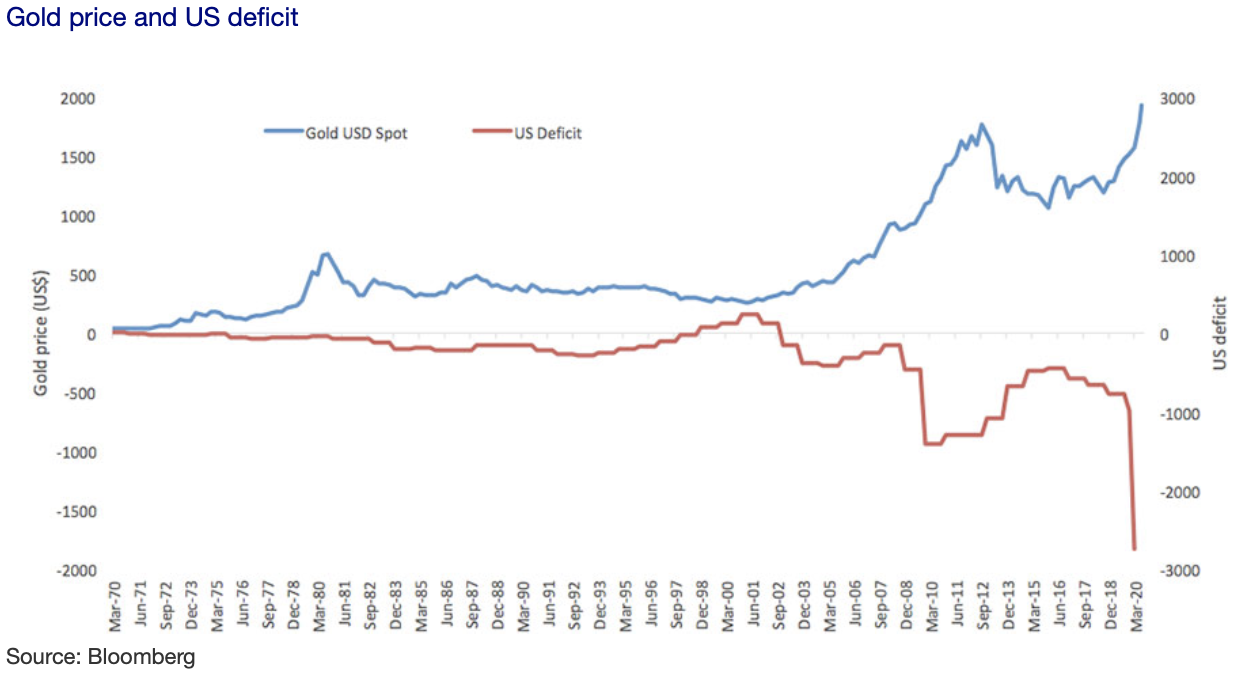

We expect it will climb over US$2,000 with gains in the precious metal having accelerated in recent weeks. Historically, the gold price has a negative correlation to the US budget deficit, as can be seen in the chart below.

US dollar dives

Alarmed by record levels of government debt, investors have sold off the US dollar, further supporting the gold price. As the US monetary system comes under pressure, the US dollar’s status as the world’s reserve currency under the Bretton Woods Agreement is being eroded.

Confidence in the US dollar, too, is falling given the COVID-19 pandemic shows no sign of easing and the notably poor management by US President Donald Trump. US clashes with China and an upcoming US election are also raising anxieties.

Reflecting the flight to relatively safe assets, ETFs globally have added 622 tonnes to their gold hoard this year (as at 6 July), which is already more than in any full calendar year period since gold ETFs have been in existence, so huge is the demand for the precious metal, according to Bloomberg data.

What’s the appeal of gold companies?

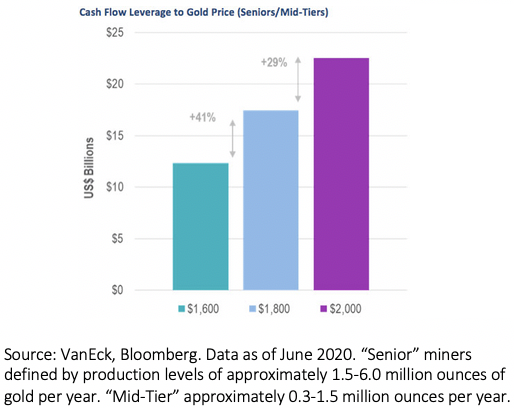

With the gold price likely to rise over US$2,000, the advantage of holding gold miners is that their price typically rises more than the gold price itself as gold miners will add their own margins to gold production. Many miners pay dividends too, adding to the potential return.

This is a powerful reason to invest in gold miner ETFs, to offset rising systemic risks during the COVID-19 outbreak and beyond. And the good news for investors is that gold equities are still relatively cheap. Juniors and mid-tier miners are deeply discounted on a Price/Net Asset Value basis.

Gold companies are becoming more profitable too as the yellow metal rises in value. Since the GFC, gold companies have been implementing changes to address mistakes of the past which, in our opinion, should lead to outperformance by gold equities relative to bullion in a gold bull market.

Companies’ reductions in costs and capital expenditures could translate to a significant increase in free cash flow (FCF). Indeed, a US$200 move in the gold price from current levels has the potential to translate to strong double-digit increases in FCF.

Investors can access the opportunity to invest in gold mining shares on the ASX with an ETF, like our VanEck Vectors Gold Miners ETF (ASX: GDX), the world’s largest gold miners ETF.

GDX holds several Australian gold miners, including Newcrest (ASX: NCM), Evolution Mining (ASX: EVN) and Northern Star (ASX: NST), which have all made acquisitions in North America over the past year and are starting to use their clout to expand globally.

Across its whole portfolio, Canadian firms account for around half (54.4%) of GDX’s holdings, while the United States (18.2%) and Australia (14.7%) rounded off the top three at 30 June. GDX also holds the world’s largest gold miners Newmont and Barrick Gold.

This report was written by Russel Chesler, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.

[ls_content_block id=”14948″ para=”paragraphs”]