In the world of investing, the S&P/ASX 200 (INDEXASX: XJO) gets the most attention for Australian shares. It is on the newswires and is the market benchmark that fund managers either track or aim to outperform.

However, another S&P/ASX market capitalisation index, one that is often overlooked, is the one that has the most outstanding performance track record: the S&P/ASX MidCap 50 Index, aka the Mighty MidCaps.

The MidCap 50 Index is diversified across all the sectors of the Australian economy and gives exposure to Australian growth opportunities, including the much-hyped technology sector including Afterpay (ASX: APT), WiseTech (ASX: WTC), Xero (ASX: XRO), Altium (ASX: ALU) and NextDC (ASX: NXT), to name a few.

How sweet it is

Australian Mid-Caps are the ‘sweet spot’ of the Australian share market universe and represent companies with the spirit of small companies combined with the maturity of large companies.

There are several reasons mid-caps are often referred to as the ‘sweet spot’ of the Australian stock market:

- This is where M&A happens. For example TPG/Vodafone, Healthscope, OZ Minerals’ takeover of Cassini;

- Capital expenditure is generally higher. Mid-caps tend to reinvest more in their business than large-caps;

- Greater agility. Due to their size mid-caps are able to respond more quickly to growth opportunities; and

- Room for growth. Mid-caps often experience higher revenue and net income growth than large-caps.

Performance

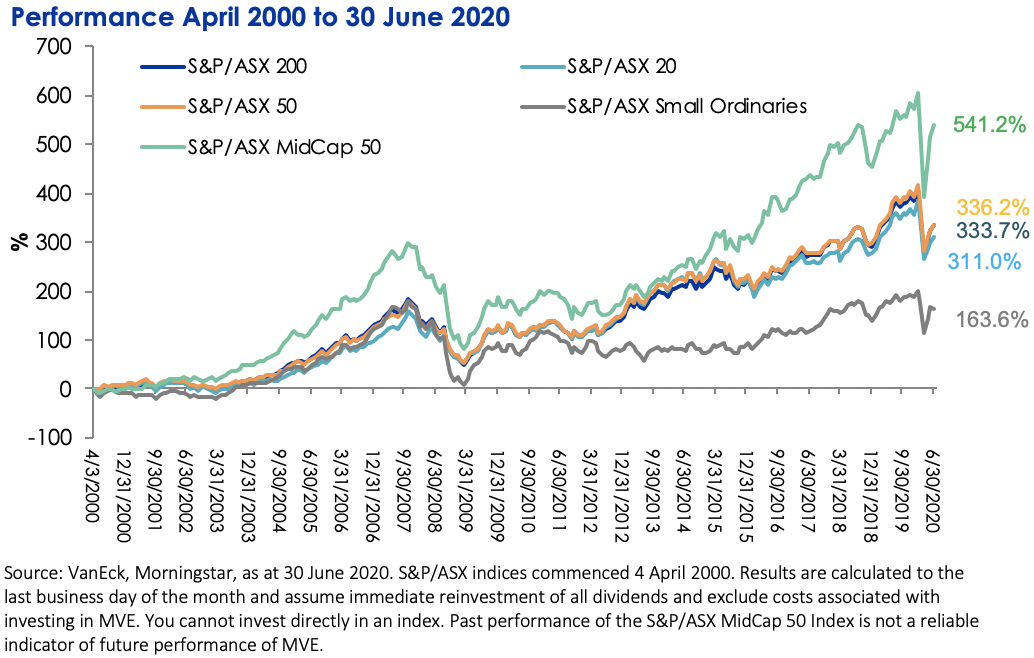

Since their inception in April 2000, the S&P/ASX MidCaps Index has been the star performer compared to the S&P/ASX Small Ordinaries Index and the large-cap dominated indices.

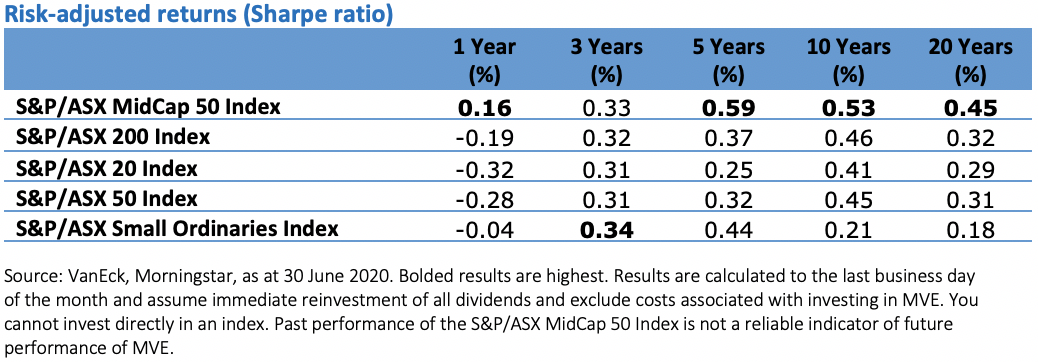

Using the Sharpe ratio as a measure, which takes into account returns and volatility, the S&P/ASX MidCap 50 Index also has the most favourable risk-adjusted performance compared to other S&P/ASX indices. The greater the value of the Sharpe ratio, the better the risk-adjusted return.

The table below shows that the S&P/ASX MidCap 50 Index has delivered the best risk-adjusted returns over one, five, ten and twenty years.

Diversity

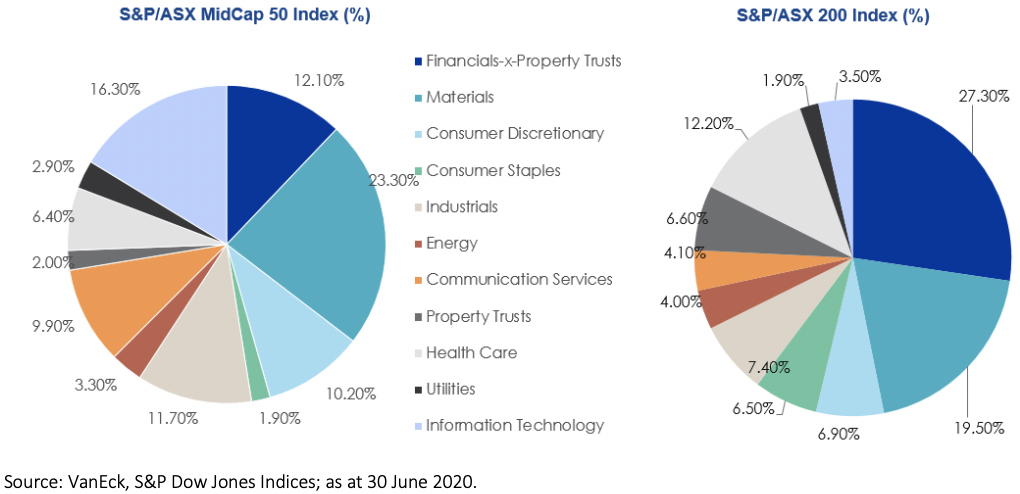

With a broad mix of technology players, healthcare shares, consumer discretionary companies and others, the ASX mid-cap sector provides increased exposure to a wide range of growth industries.

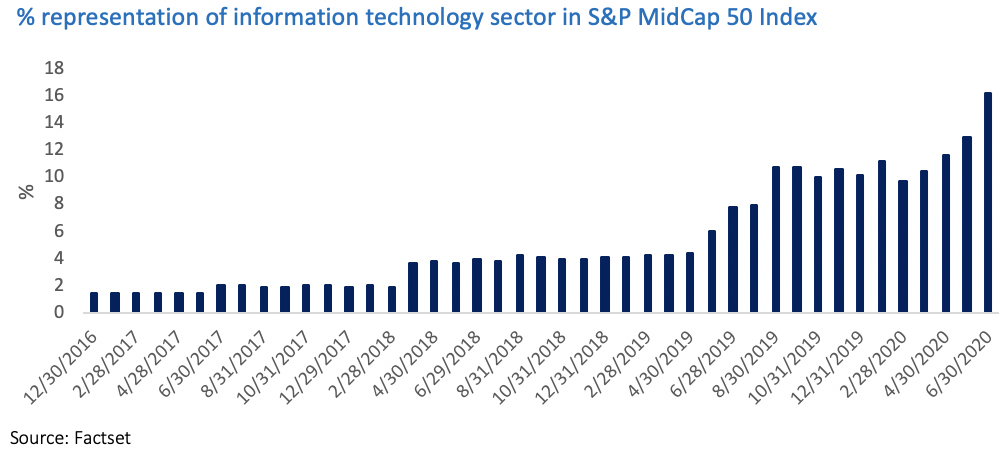

The growing importance of technology on the ASX has seen it become one of the biggest sectors in the MidCap 50 Index. At the last rebalance in June, NextDC graduated to the MidCap 50. Other IT names currently in the index include Afterpay, Altium, WiseTech and Xero.

The chart below illustrates the greater sector diversity of the S&P/ASX MidCap 50 Index compared to the S&P/ASX 200 Index.

Using an ETF to get exposure to the sector

While many ETFs track Australian shares, our own VanEck Vectors S&P/ASX MidCap ETF (ASX: MVE) is the only ASX ETF which tracks the S&P/ASX MidCap 50 Index.

This report was written by Russel Chesler, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.