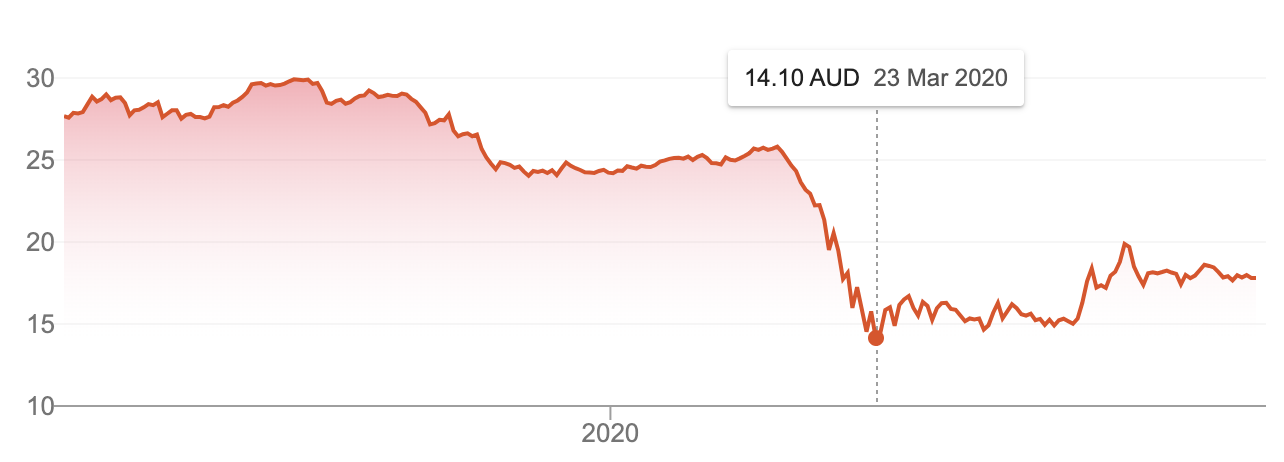

It’s been a wicked ride for Westpac Banking Corp (ASX: WBC) shares — and shareholders — over the past few months.

In the depths of the ‘COVID crash,’ the Westpac share price flopped, from over $25 to just $14.

As you can see below, it’s safe to say — much like ANZ Banking Group (ASX: ANZ) shares and National Australia Bank (ASX: NAB) shares — Westpac is yet to recover from the falls.

Fortunately, as good investors know, share prices generally follow the lead of two things (over 3 years or more):

- Strong fundamental/financial performance

- Improving investor sentiment (i.e. a better ‘outlook’)

Here are five ways to assess the fundamental performance of Westpac bank shares going forward, and before reporting season.

1. Watch those falling NIMs…

In banking, margins matter. Since they use so much leverage and interest rates are so low Aussie banks operate with very thin profit/lending margins.

The difference between the interest rates a bank pays to its savers and what it earns from its borrowers is known as the net interest margin or NIM. The wider the margin the better.

Looking at all of the ASX’s major banks — including Macquarie Group (ASX: MQG), Bendigo Bank (ASX: BEN), Bank of Queensland (ASX: BOQ) and Suncorp Group (ASX: SUN) — the average NIM was 2.01%.

By contrast, Westpac’s lending margin was 2.12%. This tells us that the bank, pre-COVID, was able to produce a better-than-average return from lending money to customers versus its peers.

The things that will influence the NIM in 2020 include:

- Bad debts and, most likely, repayment holidays

- Slower lending growth (banks make most of their interest in the first few years of a home loan)

- More expensive wholesale debt markets (the banks still rely on debt investors to fund their loans)

Shareholders should be mindful of the NIM that Westpac reports because around 80% of its total income comes from lending. It also has a large interest-only loan book…

2. Culture… kings?

This one is pretty simple: culture matters. For long term growth, banks — like any other employer — need to attract and retain good employees.

An easy way to peer into a company’s culture and its workplace is to head over to its Seek company reviews data. According to data we saw on Seek, Westpac’s overall workplace culture rating was 3.4 out of 5, slightly above-average for the banking sector. That’s good.

3. 2020: when your CET1 ratio became cool…

When a once-in-a-100-year pandemic hits, everyone flocks to safety — including the banks.

The CET1 ratio (common equity tier one) is one ratio you need to understand the defence of a bank. CET1 represents the bank’s safety capital, which it could use to protect itself against financial collapse.

In the most recent full year, Westpac’s CET1 ratio was 10.67%. This was higher than the sector average. However, you shouldn’t take this on face value or in isolation. You should compare this level of protection against its loan book and bad debts to make sure you’re comparing apples to apples.

For example, a high CET1 ratio is good. However, if the bank has been growing aggressively (i.e. growth for growth’s sake) and taking on lots of crap, high-risk or low-doc loans, the consequences of that strategy won’t be shown — or rather, felt — for at least a few years.

See: Westpac’s $1 billion AUSTRAC fine

4. The mighty ROE

There are two operating ratios often quoted in the financial media when it comes to bank shares: return on assets (ROA) and return on equity (ROE). In my opinion, ROE is probably the most popular and most relevant metric for Australian banks.

The ROE will compare the yearly profit of a bank against its total shareholder equity, as shown on its balance sheet. The higher the ROE the better since it means more profit per dollar of shareholder capital.

Westpac’s ROE in the latest full-year stood at around 10.5%. Again, that’s pre-COVID 19. This was in-line with the banking sector average.

Come reporting season, keep an eye on how many ‘exclusions’ or ‘one-offs’ the bank tries to include in its ‘cash ROE’.

5. Dividend valuations

A dividend discount model or DDM is my favourite way to value a retail bank share, like Westpac or Commonwealth Bank of Australia (ASX: CBA).

As I explain in the following valuation tutorial from our free share valuation course on Rask Education, if you make a few assumptions, you can quickly come up with your own valuation.

You can read my DDM tutorial, watch my video or take our free courses to understand how valuation works. In short, the important thing to know is that we arrive at our DDM valuation based on the sustainability and growth of a dividend.

Using its recent dividend payments and modest growth, a simple DDM valuation of WBC shares could get you to $19.79.

However, if I use an ‘adjusted’ (read: my best guess) dividend payment of $1.20 per share, to reflect the impact of COVID, the valuation goes to $13.65. The valuation compares to WBC’s current share price of $17.79.

Keep in mind, as Rask Media readers will know well, Westpac recently decided to ‘defer’ its interim dividend decision. There’s a real chance Westpac may not pay an interim dividend at all to shareholders in 2020, in which case this estimated valuation would fall precipitously.

Buy, Hold or Sell

Westpac is — by far — my least favourite big bank share.

In my opinion, it’s exposed to poorer quality assets, it’s been playing catch-up with CBA on technology — allegedly resulting in horrible outcomes for authorities trying to monitor money laundering, which as The Guardian wrote, was connected child exploitation.

In my opinion, Westpac has also had too much exposure to investors and interest-only loans.

If I was going to buy any bank share it would be CBA. But before I’d buy that I would consider something like a dividend ETF, or even Washington H. Soul Pattinson & Co. Ltd (ASX: SOL). I recently interviewed Robert Millner, the Chairman of Soul Patts. You can watch my interview with Rob Millner by clicking here.

[ls_content_block id=”14946″ para=”paragraphs”]