COVID-19 has raised awareness of the importance of ESG (environmental, social, and governance) factors in investing, particularly the S & G.

While we continue to traverse this new world shaped by a pandemic, there have already been some lessons that can help investors in the future. Companies that have strong governance frameworks that manage sector-specific risks, and those that continue to act in the best interest of communities, have shown resilience during this year’s market volatility.

Recent research too finds ESG investing can help protect investors from downside risks and help navigate unfavourable markets.

Importance of a transparent, rules-based methodology

Evaluating a company’s ESG credentials can be tricky. What one person considers to be unethical or acceptable behaviour can vary from one person to the next.

Selecting the best companies to be included in an ESG fund requires a comprehensive process that relies on extensive research and analysis. MSCI is the world’s leading index provider and ESG researcher. The MSCI World ex Australia ex Fossil Fuel Select SRI and Low Carbon Capped Index incorporates best-of-breed ESG analysis, which seeks to identify industry ESG leaders and laggards. MSCI rates companies on a ‘AAA’ to ‘CCC’ scale according to their exposure to ESG risks and how well they manage those risks relative to peers.

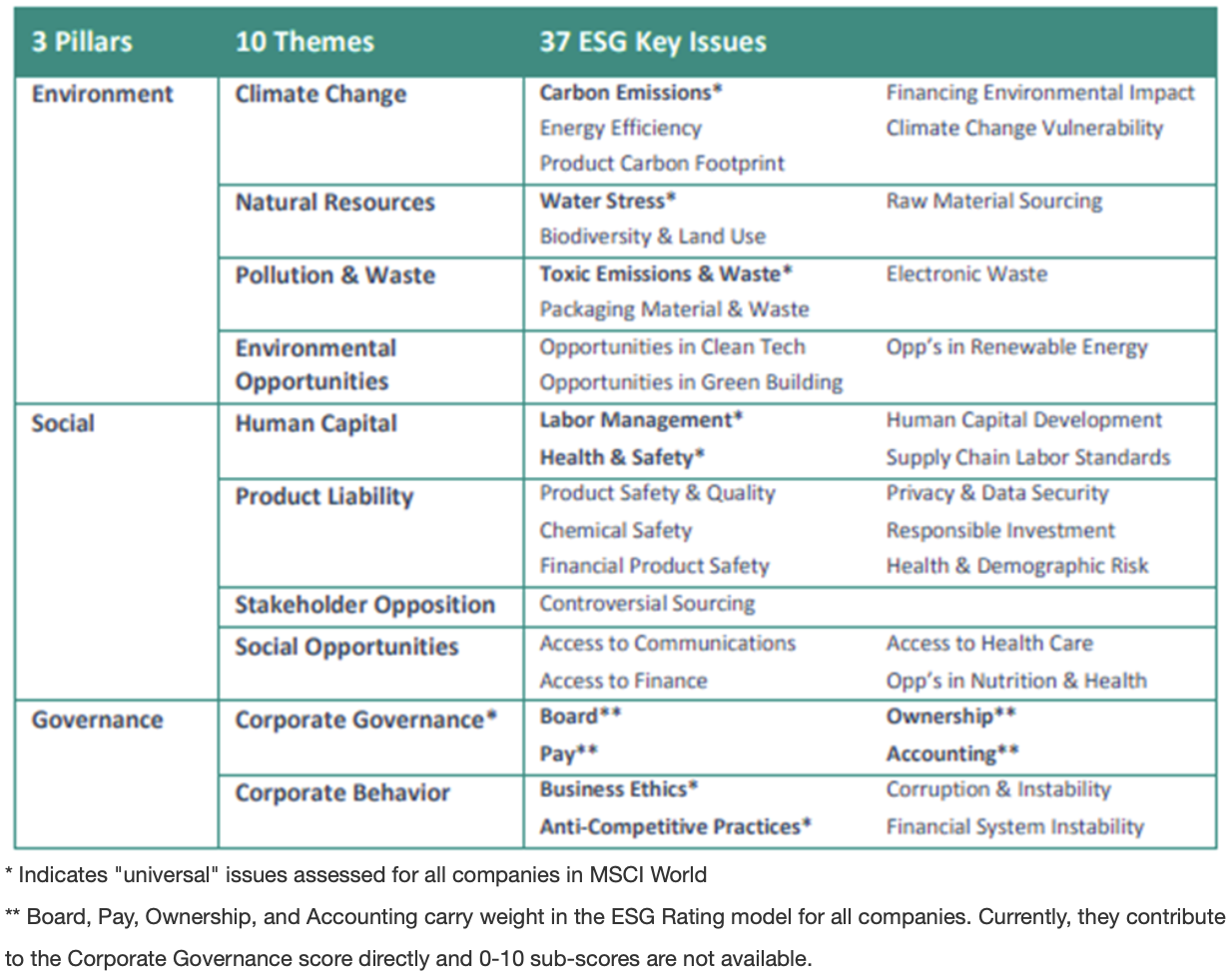

MSCI’s 200+ analysts rate 8,500 companies globally, collecting thousands of data points for each company. There are only a handful of key issues that MSCI has determined to be financially relevant. These 37 key issues, broken down by theme sit under the three pillars of E, S & G.

MSCI’s 37 key ESG themes:

The Index includes only those companies that rank in the top 15% by market cap for ESG performance from each specific sector.

Every ESG fund should have a robust and transparent framework. It should be easy to understand and it should be clear who is conducting the research to ensure there is no undue influence.

Sustainable investing helped mitigate declines

COVID-19 has accelerated awareness of ESG factors. The pandemic has raised awareness of social factors, including the responsibility of companies to minimise the impacts of the pandemic and to support the community during incredibly challenging times. What we now know is that doing “good” has helped some companies to perform well during this crisis.

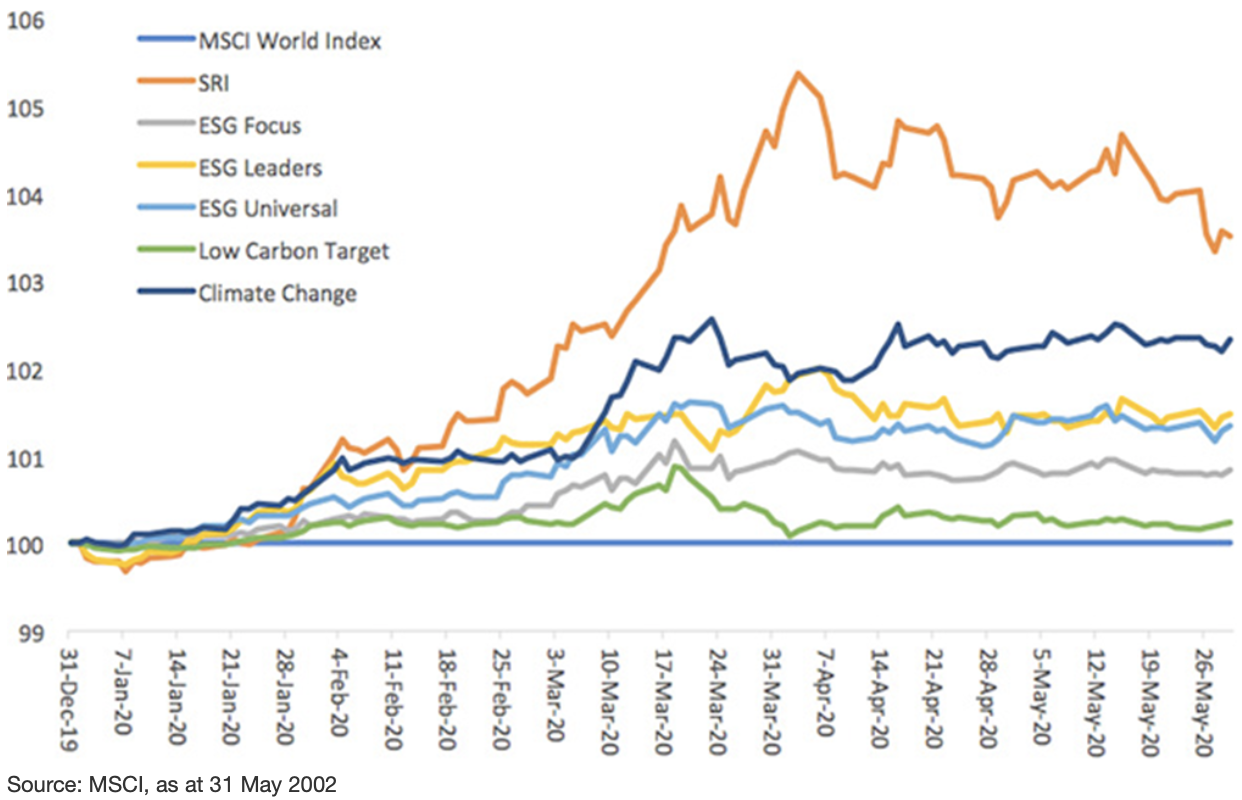

MSCI research examined the performance of ESG investments during the COVID-19 pandemic. MSCI examined the performance of six of its indices: four with explicit ESG objectives including socially responsible investing and ESG leaders; and two with explicit climate objectives, including low carbon target and climate change.

As you can see in the chart below, during the first five months of 2020, all six indices outperformed the broader share market (as measured by the MSCI World Index) with some of that outperformance attributed to ESG factors.

The results are a compelling argument to include ESG investments in your portfolio.

Relative performance of selected MSCI Indices with ESG & climate objectives:

How to access ESG analysis

Investors can incorporate MSCI’s world-leading ESG research in their portfolio via VanEck Vectors MSCI International Sustainable Equity ETF (ASX: ESGI), which tracks the MSCI World ex Australia ex Fossil Fuel Select SRI and Low Carbon Capped Index.

You can access the ESG ratings of thousands of companies via MSCI’s online search tool. In addition to rating companies, MSCI also aggregates its data to assess funds (tip: the search tool works best when using the fund name as opposed to the ASX code.).

This report was written by Russel Chesler, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.