Many investors in Australian share ETFs are typically faced with a choice of using an equal-weight ETF like the VanEck MVW ETF (ASX: MVW) or going with a more traditional market cap-weighted shares ETF like Vanguard VAS ETF (ASX: VAS), the SPDR STW ETF (ASX: STW) or the BetaShares A200 ETF (ASX: A200).

In this brief article, I take a look at the idea of equal weighting and how to think about the pros and cons.

Featured video: what is an ETF?

What on earth is equal weight?

When looking at ASX ETFs

, two terms you are likely to come across are “equal-weighted” and “market-cap-weighted”. What’s the difference, and does it matter which one you pick?

If an ETF provider is talking about weighting, they are usually referring to how much of the ETF is invested in each company, asset, industry, or sector that is held by the ETF. Market cap weight and equal weight are two common methods used to determine the weighting of each asset.

Market-cap weighted

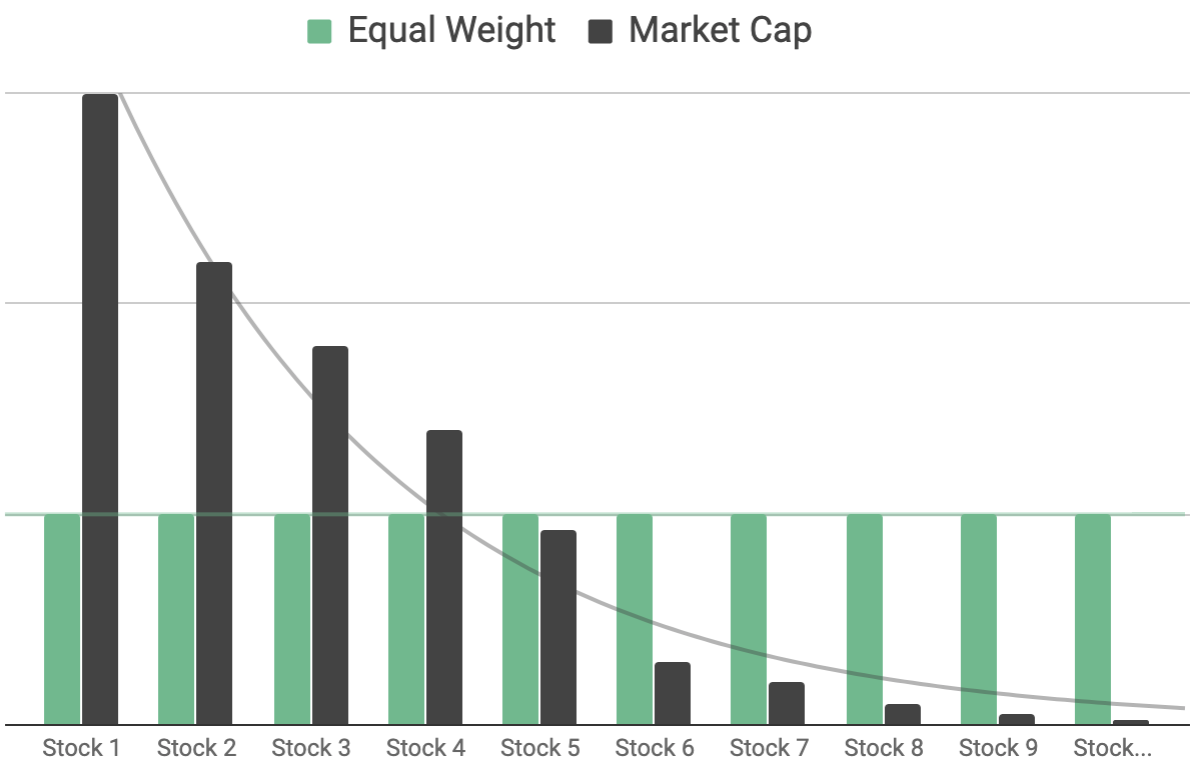

Market cap weight, or market capitalization weight, is the more common of the two. This method looks at the size of each company and assigns weightings based on the relative value. To determine the portion of the ETF allocated to a particular company, the ETF provider would take the market cap of a company and divide it by the total value of all of the companies in the portfolio.

The practical implication of this is that large, well-established companies receive the highest weightings while smaller companies in the index make up much smaller portions of the ETF. An example of this is the BetaShares Australia 200 ETF (ASX: A200), which holds 200 companies, but the top 10 companies inside the ETF make up more than 40% of the portfolio.

Equal weighted

The main alternative to market cap weighting is equal weight. This is every company in the ETF is allocated the same portion of the funds no matter the size of the company.

For example, the VanEck Vectors Australian Equal Weight ETF (ASX: MVW) holds 85 companies, all with weightings between 0.75% and 2%. The reason for the exact differences between position weights is that these types of funds must be periodically rebalanced to maintain an equal weighting, otherwise, high growth companies end up with higher weightings over time.

Does it matter which one I choose?

The short answer is yes.

Even though a market-cap-weighted ETF and an equal weight ETF may hold exactly the same companies or assets, the overall exposure can be vastly different.

Market-cap-weighted ETFs can become highly exposed to individual sectors or companies that dominate the market. This is particularly the case in countries like Australia, where we have a “top-heavy” market (i.e. the majority of the total market value is concentrated in just a handful of companies).

An equal weight ETF may provide greater diversification and spread risk more evenly across the basket of assets. However, if the largest companies have become large due to high growth and strong competitive advantages, you may miss some of that growth opportunity with an equal-weight ETF.

The point to make here is that these weighting methods can take the same pool of assets and produce vastly different results over time by offering different levels of risk, dividends, volatility, and growth. One method is not better than the other, and the choice you make should depend on your investment objectives and risk profile. The important thing is to understand the difference and, as always, do your research before committing to an investment.

This article by Max Wagner originally appeared on Best ETFs Australia.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclaimer: At the time of writing, Max owns shares in the BetaShares Australia 200 ETF (ASX: A200).