The Afterpay Ltd (ASX:APT) share price was trading 23% higher today following news it welcomed a new substantial shareholder in Chinese technology company Tencent Holdings Ltd (HKG: 0700).

For context, the broader Australian share market or S&P/ASX 200 (ASX: XJO) was trading up 1.08%.

About Afterpay

Afterpay Touch is the owner of the popular “buy now, pay later” app. As of 2020, Afterpay had over 7.5 million registered users worldwide, making it one of Australia’s true technology success stories.

Afterpay Ltd’s new investor

Afterpay shares were trading up to 35% higher today following an update released late on Friday saying that Chinese technology firm Tencent had built a 5% stake in Afterpay after it began purchasing shares in March.

Tencent shares trade on the Hong Kong Stock exchange. They provide internet value-added services, including digital entertainment, online advertising, and FinTech and cloud services to users. Its communications platforms include Weixin, WeChat and QQ. Its Weixin Pay service is the leading mobile payments platform in China, facilitating an average of over 1 billion commercial transactions per day.

“We feel very privileged to welcome Tencent as a substantial shareholder in our business. Being able to attract a strategic investor of this calibre is extremely rewarding and is a testament to our team and the strength of our differentiated business model,” Co-founders of Afterpay Anthony Eisen and Nick Molnar commented.

“Tencent’s investment provides us with the opportunity to learn from one of the world’s most successful digital platform businesses. To be able to tap into Tencent’s vast experience and network is valuable, as is the potential to collaborate in areas such as technology, geographic expansion and future payment options on the Afterpay platform.”

“We remain focused on delivering value for our new and existing shareholders over the long term,” Eisen and Molnar explained.

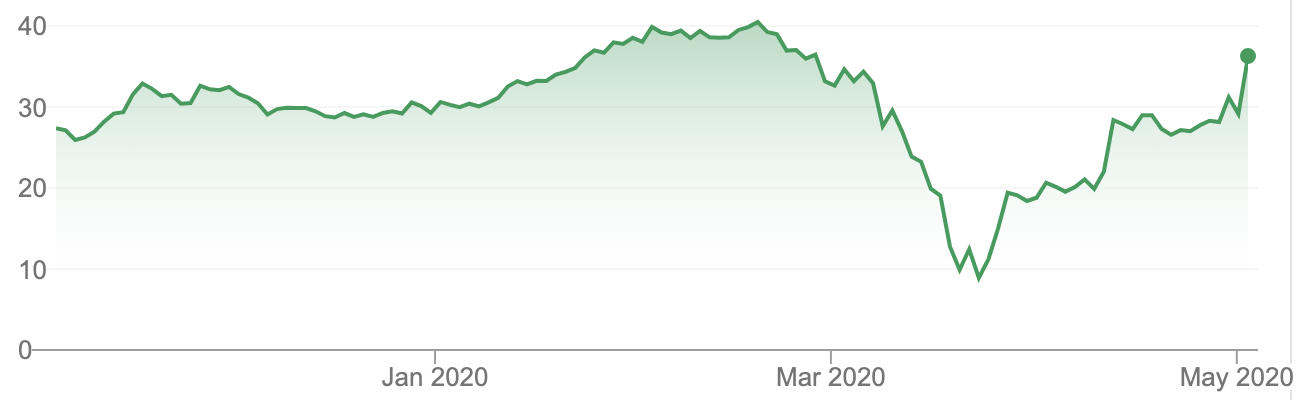

Since lows around March 23 2020, Afterpay shares are up more than 300%.

In fact, on the 23rd, Afterpay shares were struggling along at $8.90. This was due to a massive downturn in consumer spending brought on by the Coronavirus (COVID-19).

What now for Afterpay?

The Afterpay announcement has also sparked a rise in rival company Zip co. (ASX:Z1P). Zip was trading up 6.5% on Monday.

For Afterpay, this announcement is great news for investors as it means the company can now align themselves with one of the biggest players around the world and put together strategies beneficial for all.

Afterpay shares were last seen trading at $36.13, giving the company a market capitalisation more than $5 billion.

[ls_content_block id=”14945″ para=”paragraphs”]