The Santos Ltd (ASX: STO) share price was trading 7.52% higher today following the release of its quarterly update.

For context, the broader Australian share market or S&P/ASX 200 (ASX: XJO) was trading at 5211.5, down 0.19%.

About Santos

Santos is one of Australia’s largest oil and gas companies. Founded in the 1950s, Santos owns and operates one of Australia’s largest portfolios of oil and gas fields, connected by extensive pipelines and complementary facilities.

Santos’s first-quarter findings

Santos Limited released its first-quarter activities report today. First-quarter production of 17.9 million barrels of oil equivalent (mmboe) was 4% lower than the prior quarter. It also reported approximately 70% of forecast production volumes for the remainder of 2020 are fixed-priced. This is very promising given the uncertainty in the current market.

In terms of comparative performance for the March 2020 quarter, Santos reported the following (versus the same period of 2019):

- Production was down 3%

- Sales volumes were down 2%

- Sales revenue was down 13%

Another factor that has obviously harmed oil prices is the COVID-19 pandemic. Santos Managing Director and Chief Executive Kevin Gallagher has explained Santos are implementing multiple measures to ensure the safety of its people.

“In response to COVID-19, the financial initiatives we announced on 23 March demonstrated we are taking decisive action to ensure Santos is well-positioned in a lower oil price environment. Production levels from our current assets are relatively steady for the next four or five years without any new growth projects and all our major capital projects are yet to take final investment decisions, providing flexibility in commitment timing,” Mr Gallagher said.

“Our disciplined, low-cost operating model continues to drive strong performance. Free cash flow generation from our portfolio of low-cost assets was US$265 million in the first quarter. ”

Looking forward, Mr Gallagher said, “For the remainder of 2020, around 70% of our forecast production volumes are either fixed-price domestic gas contracts or oil hedged at an average floor price of US$39 per barrel.”

The current environment is a time for discipline. We have a strong liquidity position with over US$3 billion available and we have sufficient headroom in our debt covenants for a number of years at current oil prices.”

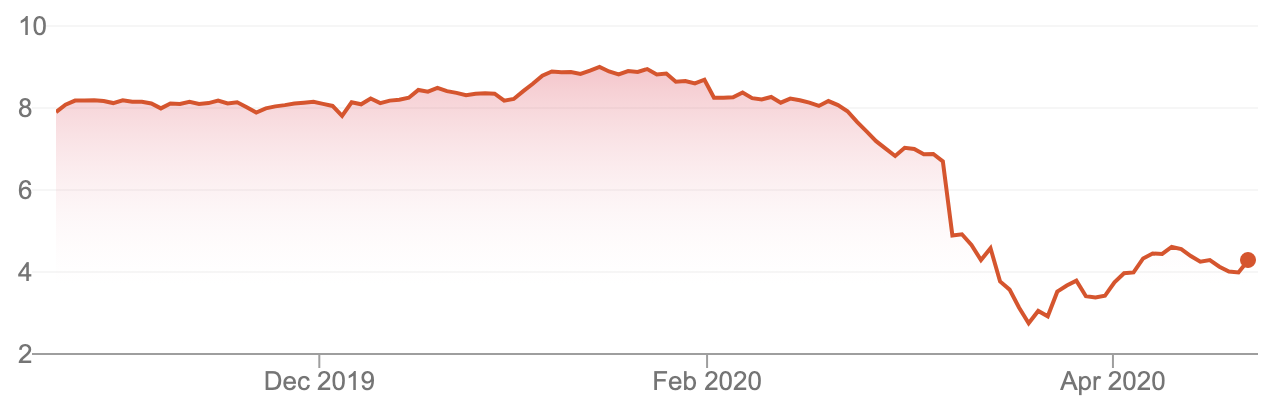

It has been a very tough time for Santos over the last few months. As you can see in the below chart, Santos shares are still well below their prices at the beginning of 2020.

As with many industries which have been affected by Coronavirus, Santos is in for a tough few months ahead. With that being said, they have positioned themselves well to ride the storm with over US$3 billion of capital available to them. It looks as though investors have enjoyed the report and are regaining confidence in Santos. That being said, shares are still trading more than $3 behind where they were at this time last year.

Santos shares were last seen trading at $4.29, giving the company a market capitalisation more than $5 billion.

[ls_content_block id=”14948″ para=”paragraphs”]