The Afterpay Ltd (ASX: APT) share price and WiseTech Global Ltd (ASX: WTC) share prices have been on a tear these past few days despite more economic concerns sparked being sparked by the Coronavirus outbreak.

APT & WTC share prices bounce back

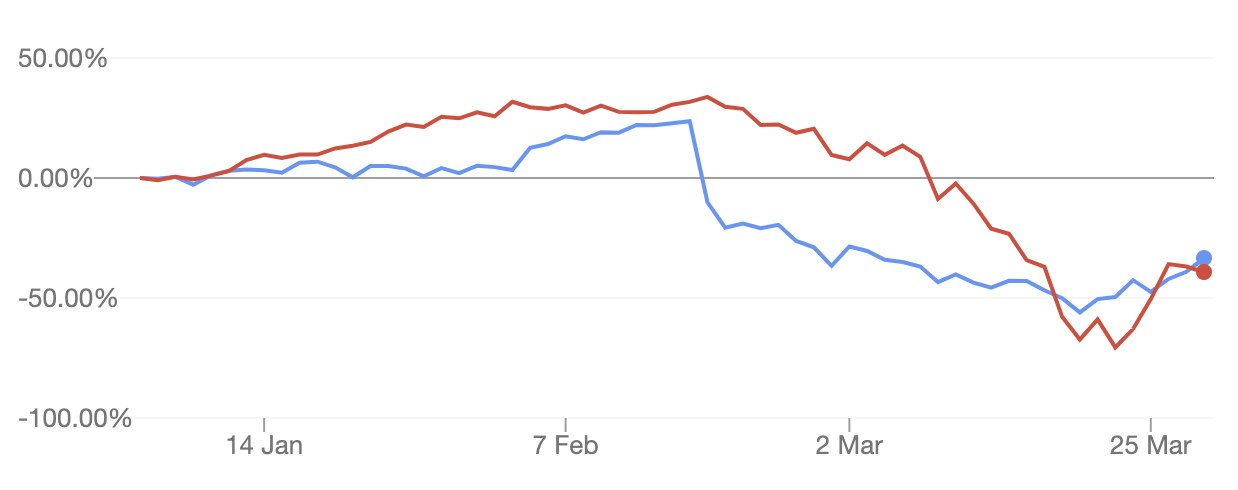

Both Afterpay and WiseTech shares are down heavily since the beginning of 2020 (39% and 33%, respectively), as can be expected.

However, at one point in time Afterpay shares had fallen more than 70% from their 2020 peak just a few weeks earlier.

Analyst valuation of Afterpay shares

According to analysts surveyed by The Wall St Journal, 8 of the 13 analysts providing ratings on the stock label Afterpay as a Buy and have slapped it with an average price target of $31. That compares favourably to the current share price of around $18.

A month ago, the spread of analyst ratings was slightly more negative, hinting that analysts could now be turning more positive despite concerns over bad debts and the likelihood of rapidly rising unemployment in Australia, the UK and USA.

Analyst valuation of WiseTech shares

The same positive shift in sentiment can also be said about analysts covering WiseTech Global. The average analyst price target is $21 for the company, hinting at slight undervaluation.

However, as we always say here at Rask, you should take analyst price targets with a pinch of salt because they are almost never exactly right. Specifically forecasting the future is very difficult, especially when we consider the complexity of contagious viruses impacting businesses and consumers.

What now?

While both companies have noticeable risks, there is a lot to like about owning technology darlings like these over the long run — especially for those who have thick skin and acknowledge the heightened risks.

WiseTech is becoming one of the leaders in software for distribution and logistics companies throughout Europe and the UK. While these areas are deeply affected by COVID-19 right now, and likely will be for at least six months, WiseTech stands to benefit as its CargoWise product effectively ‘clips the ticket’ on every parcel monitored by its systems.

Afterpay is the leading Buy Now, Pay Later business in Australia and it’s taking on the globe. Like WiseTech, it is facing the prospect of much slower growth in the USA and Europe as the COVID-19 outbreak will prompt millions of consumers to avoid spending on discretionary items (think fashionable clothing, electronics, etc.).

This lower growth rate is one reason I’m still skeptical of the analysts’ valuations — they might not have been updated yet to properly reflect the curb in discretionary spending throughout Afterpay. This can also drive up customer acquisition costs (CAC). If you’re thinking about buying Afterpay shares, you should read our analyst’s review of the company: “The real reasons Afterpay is down 70%”

That said, if Afterpay survives the recession and lives to tell the tale it could go on to become a promising payment provider and advertising business.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: the author of this article does not have a financial or commercial interest in any of the companies mentioned.