I recently covered the fall in the Serko Ltd (ASX: SKO

) share price and Webjet Limited (ASX: WEB) in a recent article here on Rask Media. Here are my latest thoughts…

Serko (SKO) shares – a “hold”?

As noted on this website in times gone by, Serko has witnessed impressive growth in many ways: revenue growth, new clients, new geographies, etc.

However, right now, it pays to be extra cautious of the travel industry because we’re yet to see the full-cycle economic impact of travel bans and quarantine, especially in developed markets.

What was most likely a travel ban on international travel will now see bans on any type of leisure and travel completely. That means a complete shut down on corporate travel bookings, including domestic travel. Depending on government intervention this will probably last for the next 6 months, at least.

Again, I think Serko’s business should have some insulation from the travel industry’s collapse because it provides software. And as we know, mission-critical software is often the last thing company’s cut from their budgets because they depend on it, and it usually makes up a small slice of the costs of a business.

That said, financials are obviously very important and come first. I don’t have the clarity or conviction in Serko’s financials right now, so I’m avoiding buying shares.

Webjet (WEB) shares – a sell?

In contrast to Serko, we know Webjet is in a world of pain right now.

This week, Webjet shares went into a trading halt as it plains to raise capital. This will likely be a severe blow to current investors because it will likely come at a hefty discount to historical share prices.

I think the reasons it’s doing the capital raisings are clearly identified in the following extracts of its half-year report:

What this means…

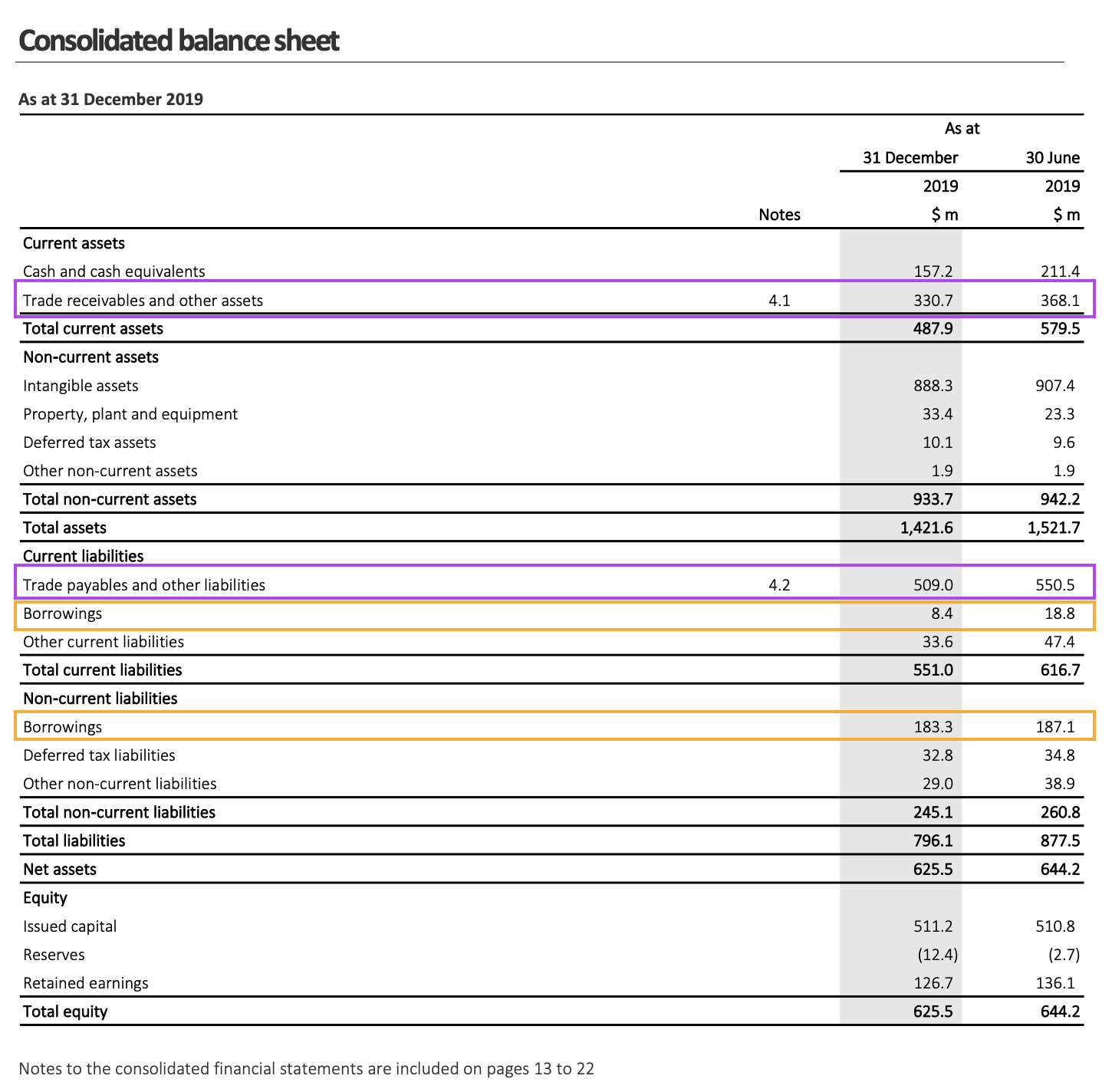

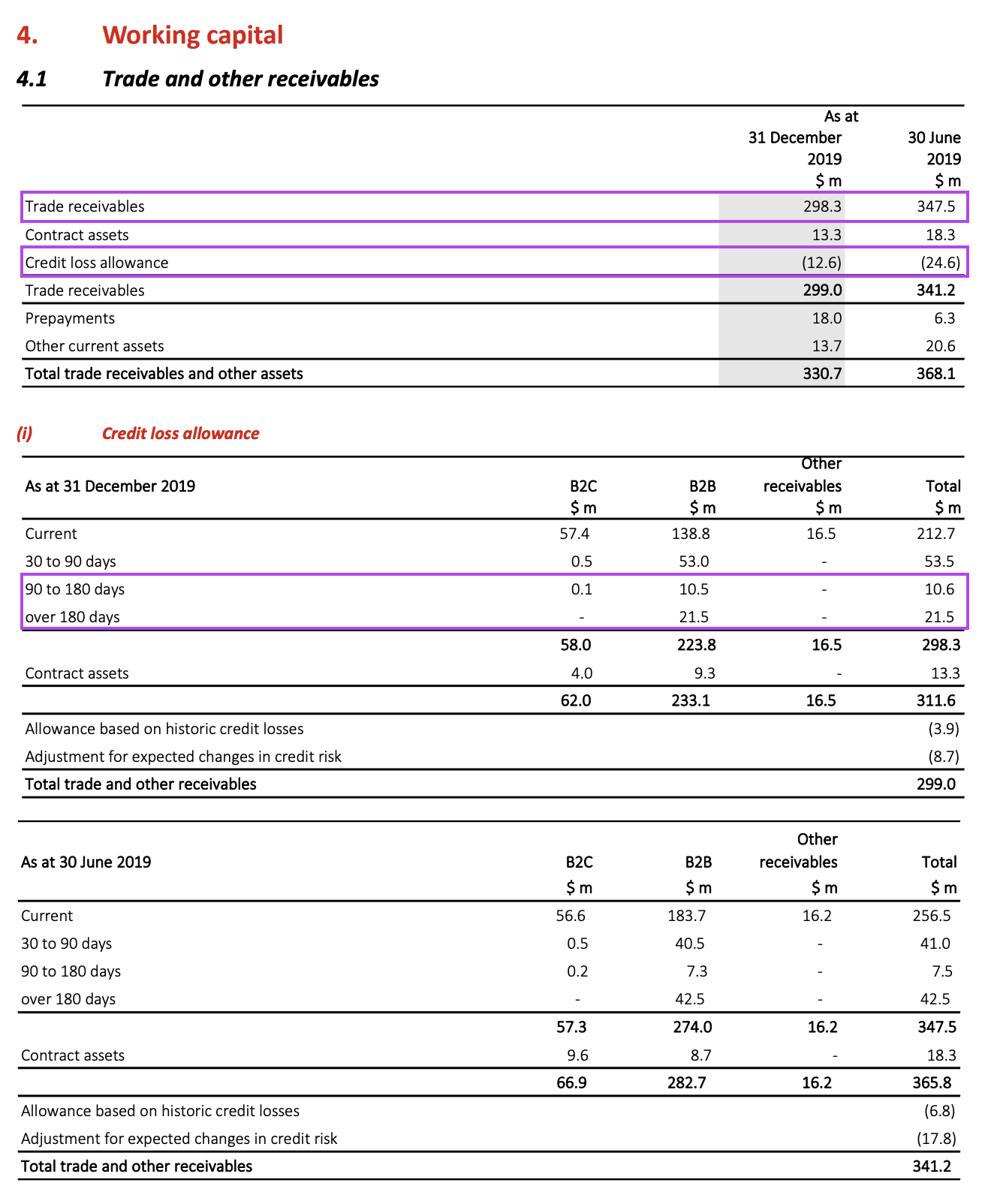

Hopefully, management can raise enough capital from new investors to squash a steep increase in short-term cash flow problems (“working capital”). The squeeze will come from a rise in debts to Webjet (rising trade receivables lead to greater credit loss allowances) and what Webjet is required to pay to suppliers (trade payables).

We also have all of the usual costs associated with wages, servers, loan repayments, leases, rent, etc., that every company must contend with right now.

In the medium and long term we have debts due, too. These are a problem area for any company dependent on debt right now. However, it seems the maturities on Webjet’s loans are a few years out (1-5 years)? I hope and expect management will try to raise enough capital that this risk is squashed too.

Ultimately, I won’t be a buyer of Webjet shares right now. If I were a large, well-capitalised private equity fund or wealthy investor I might be tempted… but I’m not either of those things.

I think there are better places to have my money invested.

[ls_content_block id=”18457″ para=”paragraphs”]

Owen does not have a financial interest in any of the companies mentioned.