Some studies tell us that about once every 357 days the market goes into a “correction” (on average). A correction is a fall of 10% before a recovery.

that just one-in-five corrections turn into bear markets.

I think this means long-term investors must learn to deal with the inevitable hard times by finding strategies to cope with whatever comes next.

In this article/email, I hope to arm you with behavioural tools that might help explain what we’ve witnessed on markets in February 2020.

Many of these lessons are taken from my Value Investor Program on Rask Education. If you want to know more, that’s where you can go.

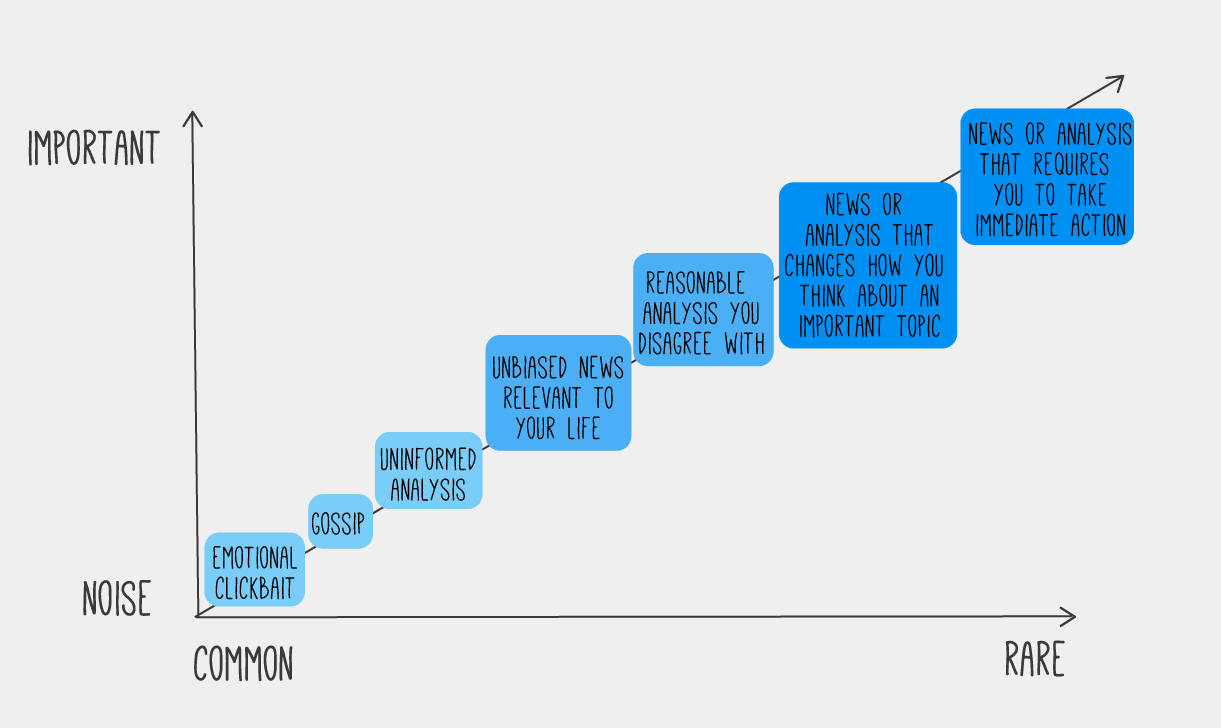

The world is getting noisier but the signal is the same.

The chart above is based on the ideas from Morgan Housel’s brilliant article, “How To Read Financial News”.

Most (I’d say 99%+) of what we read and hear in the financial news is worthless noise.

At best, it is entertainment.

At worst, it turns well-intentioned people into suckers.

If you want to survive as an investor, you must train your brain to think factually and efficiently filter out the information that is transient.

Take the Coronavirus.

Most of the headlines are forcing a wedge between your well-reasoned investment expectations and your emotions.

There’s everything from fear-mongering and fake news to important statistics about temporary declines in monthly manufacturing and empty seats on planes.

In 5, 10 or 20 years from today, how relevant will it be?

I’m willing to bet I’ll look back on the Coronavirus outbreak and its impact on the market the same way I do many other tragedies (Iraq war, 9/11, Ebola, etc.).

If the last 20, 50 or 100 years of data is anything to go by, I’m all but certain we’ll still need a place to invest our money for the long run.

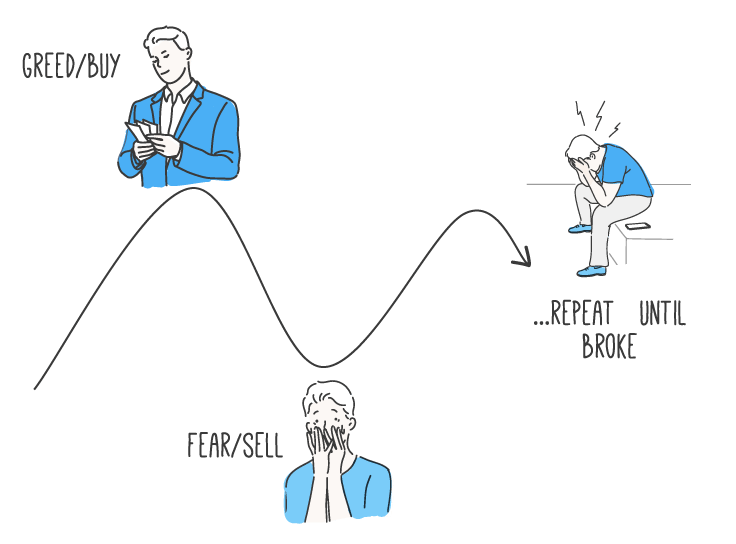

The stockmarket is one big game of emotion… you have to play it smart.

Thousands of years of evolution have taught us to see danger and run, or stand and fight. This instinctive reasoning has served the human species very well.

However, time and time again, the market has proven it isn’t a place for first-level thinking.

First-level thinking is the type of processing your mind could handle while driving your car around a corner.

Rain = the road is slippery.

Pedestrian = potential accident.

Hungry = what’s for dinner?

Second-level thinking requires effort. As I describe it in our Value Investor Program, it’s thinking in terms of probabilities and consequences. Asking why not what.

If you want to be an active investor who has ultimate control over your future, be prepared to act slow to go fast.

Most people forget to invert.

There are many deep-seated behavioural biases we fall into, yet I could never do even one of them complete justice here.

However, one of the most powerful questions you can ask yourself is ‘what evidence would make me change my mind?’

If you believe the world is going to collapse from the Coronavirus, what evidence would make you change your mind?

If you believe it’s best to sell everything and walk away from investing, what evidence would make you change your mind?

Of course, your thesis/reason for investing in a company can be broken.

Perhaps you realise the company is indeed going to be materially hurt by the outbreak or maybe the company has too much debt and not enough cashflow to survive a meaningful slowdown in the global economy.

Nonetheless, this one question will help you cut through the stories you tell yourself and persuade you and others into thinking clearer. As Winston Churchill said, “When the facts change, I change my mind.”

If there is no evidence that will change your mind, you are not rational. If there is no evidence that will change someone else’s mind, don’t waste your time.

***

If you have made it this far through my article/email, thanks for reading. You want to make better decisions.

It’s this willingness to learn that will help you think clearer during these uncertain times.

I’m confident you will make far better decisions than most. And if you do not, at least you will learn from them.

This article first appeared in my free email — which is only available if you create a free Rask account.