The Wesfarmers Ltd (ASX: WES) share price ended sharply lower on Tuesday following the announcement that it would acquire rare earths miner Lynas Corporation Ltd (ASX: LYC) for $2.25 per share.

The indicative and conditional Lynas deal announced to the market on Tuesday values the embattled rare earths miner at about $1.5 billion.

For investors in companies like Lynas and Iluka Resources Ltd (ASX: ILU), rare earths, which include minerals that are used in the production of technologies such as mobile phones, have been long on promise and short on delivery.

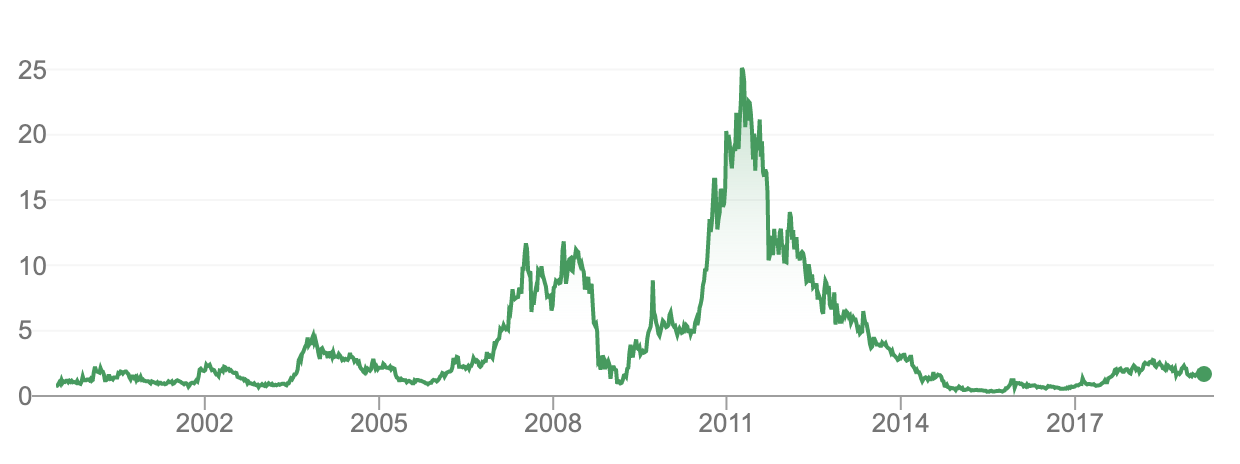

For Lynas shareholders it’s been heartache after heartache for many years, as the following long-term share price chart implies.

What’s In It For Wesfarmers?

Wesfarmers, which owns Bunnings Warehouse and other retail assets, has considerable experience in resources and mining, having owned coal mines for many years.

It also has experience in making bold acquisitions, such as when it acquired Coles Group Ltd (ASX: COL) back in 2007. Coles supermarkets was divested by Wesfarmers and sold back to ASX investors last year.

Despite these clues to what might come next, I must admit I didn’t expect Wesfarmers to take a bite at Lynas. There is substantial value in Lynas’ assets and mines, and Wesfarmers has complementary skill sets.

“Wesfarmers is uniquely placed to support Lynas’ future through further capital investment to support downstream processing assets and realise the full potential of the Mt Weld ore body,” Wesfarmers’ ASX announcement read.

My surprise at the offer and the problem/concerns for me arise in knowing that we have a high quality, conservative business in Wesfarmers moving into a hard market selling commodity products.

Sure, Lynas is one of the world’s largest rare earths miners outside of China and Wesfarmers has the capital to support growth.

Maybe Wesfarmers is looking for diversification outside of its cyclical, Australian housing-linked Bunnings business? Maybe it thinks it can work with the Malaysian government to resolve some of Lynas’ headaches in Asia? Maybe it’s an opportunistic land grab?

Whatever the case, the offer remains subject to a number of conditions and due diligence, so it’s probably too early for me to speculate as to the impact it’ll have on Wesfarmers shares.

For Lynas, at least, it’s a great development because it reinforces their belief that their assets are extremely valuable to the right buyer.

For now though I’ll watch this deal from the sidelines and happily put my money to work in other valuable and extremely fast-growing businesses, such as the two shares in the free report below.

[ls_content_block id=”14947″ para=”paragraphs”]

At the time of publishing, Owen Raszkiewicz does not have a financial interest in any of the companies mentioned.