LICs would commonly issue “free” options to their IPO investors in times gone by. Over the last year or two this practice has become very rare. The market realised that there was no such thing as a free lunch. They can easily constrain the upside of the share price due to the potential dilutionary effect.

One such LIC that has been dealing with the possibility of most of its options being exercised is Ellerston Asian Investments Limited (ASX: EAI). Over the last year, the shares have mostly traded above the exercise price of $1. In fact, the first part of 2018 saw them spend a lot of time trading around $1.10.

Investors have been cautious diving in at that higher level though, understanding that upside is constrained due to potential dilution. For example, if the NTA went well and up to $1.30 by the options expiry, most option holders would probably choose to exercise them. The shares would likely be comfortably above $1, thus taking this action would be profitable.

Interview With EAI’s Mary Manning

Dilution and Extra Supply

If all of the options holders exercised then the company would be significantly boosting the shares on issue. Many LIC IPOs used to issue one option for every share held meaning the shares on issue can double. They would be effectively raising new capital at $1. Taking the example above if the NTA was $1.30 beforehand, the effect of this would be to bring it back to $1.15.

Note that Ellerston Asian Investments only issued 1 option for every 2 shares held though. I have just used the above example for simplicity and what often occurs. The effect, in this case, would be less severe.

From this example, it is not surprising to think that investors would be reluctant to bid the shares up too high in 2018. If the NTA were to surge then their gains would be somewhat constrained. Then there is the extra number of shares on the market which may also weigh on the share price.

Minor Dilution A Positive Catalyst?

Fast forward to the end of February 2019 where the options will expire. After the early months of 2018 Asian markets had a tough time of it last year and EAI shares have eased. They have tended to hug the option expiry price of $1, whilst the NTA has often been around $1.10.

With the shares so close to the option strike price we will likely see far fewer options being exercised than we would have expected a year ago. Dilutionary impacts should be minor and the market won’t have to digest as many new shares coming on to the market.

The negative issue is that an opportunity to boost the fund size of Ellerston Asian Investments in a major way may have been lost. That could have boosted liquidity and lowered the management expense ratio of this LIC. Overall though I see the positives outweighing the negatives for how the stock may perform during the remainder of 2019. It is still well over $100 million in size so I don’t think this is a big problem like many other much smaller LICs are dealing with.

Have We Seen This Trend Play Out Before?

During 2017 I noticed some similarities with how the option expiries transpired with Platinum Asia Investments Limited (ASX: PAI) and Future Generation Global Investment Company Limited (ASX: FGG). In these cases, the share prices hugged the option expiry price levels and plenty of the options lapsed. This assisted in reducing the dilutionary effect and limiting the number of new shares to hit the market.

The share prices in these two examples were very strong after the expiry of their options. I want to make it clear the key reason was that equity markets, in general, were quite bullish at the time. We also saw both of these LICs move from discounts to premiums to NTA. I believe the removal of the options overhang however also played a part in the discounts closing.

What Shares Do Ellerston Asian Investments Own?

The above discussion is more relevant from a shorter term perspective in regard to the timing of an entry into the stock. We should not lose sight of the fact that the underlying portfolio is the key to long term investment returns.

Asian equity markets had a disappointing 2018, posting negative returns and underperforming US markets. This reversed the opposite trend seen in 2017. Currently, on a range of valuation metrics, Asian markets appear at extremely cheap levels versus the US. Issues such as historical volatility, corporate governance and political stability are certainly some reasons cited that warrant a discount. It is not clear to me though why such discounts should be near historic wides. Therefore having some Asian equities exposure to my portfolio appeals.

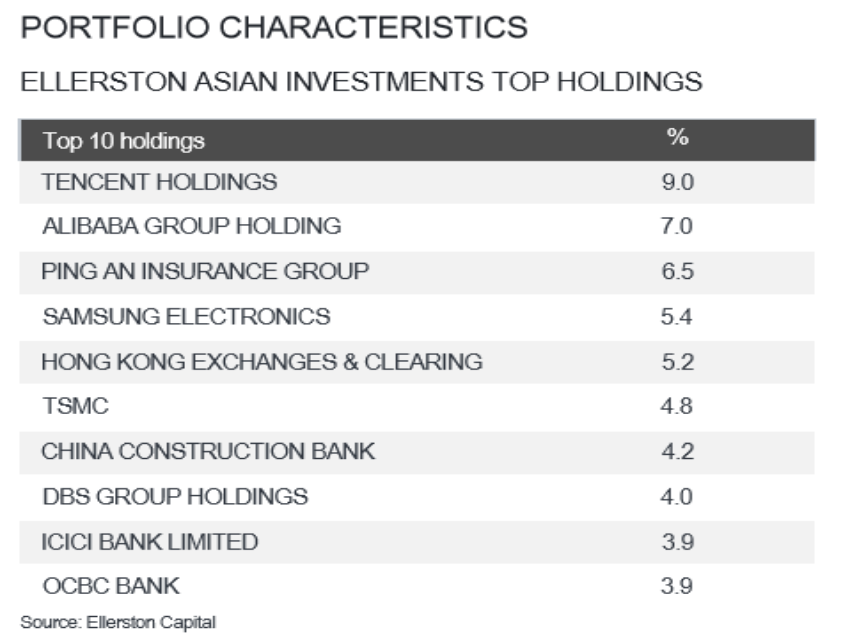

They have a reasonably concentrated portfolio that contains companies that many would be familiar with. Below is the latest top ten holdings from their January NTA report.

I have found the relative performance of this LIC however disappointing thus far, well short of its benchmark. Nonetheless, there is an argument that using an active manager for exposure makes more sense in less developed markets. I do see the rationale in this view, but also concede it is a handy fall back for the marketing department of active managers. The fee structure, in this case, is a little cheaper than I often come across however with global LICs.

Conclusion

Here we have the removal of the options overhang, a reasonable discount to NTA, and a sustainable small dividend now in place for Ellerston Asian Investments. The options as I write are a fraction “in the money”. That could encourage some to exercise at $1 and maybe bank a small quick gain. Some extra supply and minor dilution could suppress the share price in the next few weeks. I would watch if this keeps the shares very close to $1 whilst the fully diluted NTA moves comfortably north of $1.10. That could be an attractive entry point to use the stock for some Asian exposure to your portfolio.

[ls_content_block id=”14948″ para=”paragraphs”]