Kogan.Com Ltd (ASX: KGN) has just reported more revenue growth in the December 2018 half year, is it a buy?

Kogan.Com is an online business that was set up by Ruslan Kogan in 2006 in his parent’s garage. Kogan.Com offers a variety of products and services including Kogan Retail, Kogan Marketplace, Kogan Mobile, Kogan Internet, Kogan Insurance and Kogan Travel. The company plans to launch Kogan Super in the near future. Kogan.Com aims to offer consumers price leadership through digital efficiencies.

What growth did Kogan.Com report?

The company reported it achieved trading in the important Christmas period with Black Friday and Boxing Day sales also producing record results. The core divisions of ‘Exclusive Brands’, ‘Partner Brands’ and Kogan Mobile all grew revenue and active customers during the half.

The business achieved 32.2% year on year active customer growth to 1.54 million people.

Its unaudited management accounts showed that it recorded total revenue growth of 9.7% in the half year with a similar gross margin to last year.

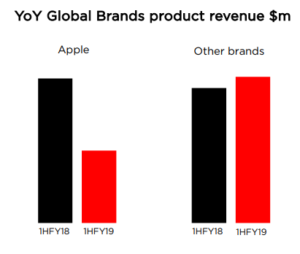

Within the core divisions, ‘Exclusive Brands’ revenue grew by 23.6%. However, ‘Global Brands’ revenue decreased by 46.7%. Kogan.Com blamed subdued demand for Apple products and avoidance of GST by foreign websites as the cause.

Excluding Apple, Global Brands product revenue increased by 8.5%. This section includes Samsung, Google, Xiaomi and so on.

Kogan.Com Founder and CEO Ruslan Kogan spoke about the investments the company has been making:

“We have invested in the Kogan brand, our logistics capability, and our inventory in the lead up to the back-to-school trading period. We have also improved our marketing performance and the efficiency of some of our variable costs.”

However, Kogan.Com did warn that its market expenditure increased by around 25% and the overall expenditure on variable costs grew by under 30%.

The final update was regarding the ACCC investigation, Kogan.Com said it’s cooperating about the June 2018 promotion, but there is no update at this stage.

Is Kogan.Com a buy?

Before the start of trade today the Kogan.Com share price had fallen 67% since the start of June 2018, so it was valued at 22x FY18’s earnings.

Kogan’s founders sold a big chunk of their shares in 2018, which is rarely a good sign. But while management share sales were not ideal, I think it didn’t necessarily break the thesis or reason to buy Kogan shares.

Kogan.Com’s expansion into the categories of home loans and superannuation could work well considering customers may looking for the cheapest offering in those two industries.

All-in-all Kogan.Com is an interesting investment idea and I can see both the bull and bear cases for it. Online retail is only going to grow from here, but it could be Amazon that takes the lion’s share.

Therefore, if you’re looking for growth shares, the two stocks in the free report below could be more likely to succeed for a portfolio.

2 ASX rapid growth shares for your portfolio

[ls_content_block id=”14947″ para=”paragraphs”]