The Praemium Ltd (ASX: PPS) share price is up 4%, the financial technology business revealed its December 2018 quarterly figures.

Praemium was established in Australia in 2001. It’s a provider of investment platforms, investment management, portfolio administration and CRM solutions with offices in Australia, the UK, Jersey, Armenia and Hong Kong. Praemium launched its services into the UK market in 2008, where it is now one of the fastest growing discretionary platforms available.

Praemium’s record December 2018 quarter

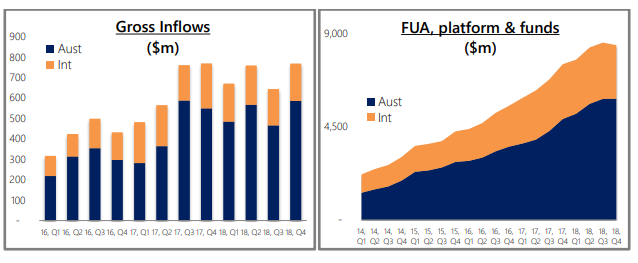

In the December 2018 quarter, Praemium achieved combined quarterly gross inflows of $768 million, the highest on record. Australian gross inflows came in at $585 million and international gross inflows of $183 million.

During 2018 Praemium had record annual gross inflows of $2.8 billion, which was 10% higher than the 2017 calendar year. The company is benefiting from advisers looking to find cheaper independent platforms after the big institutions like National Australia Bank Ltd (ASX: NAB) and AMP Limited (ASX: AMP) suffered reputation damage in the Royal Commission.

The company reported a few bits of news regarding its UK growth. UK platform clients increased by 34% from 136 to 182. Praemium achieved record UK gross platform inflows of £97 million for the December quarter.

Praemium CEO Michael Ohanessian commented on what to expect in 2019, “In the new year we will reach a key milestone with the imminent release of our signature development program – a next generation Unified Managed Accounts (UMA) solution”.

Whilst this update was good, Praemium is not the type of business I want to add to my own portfolio as it’s not easy for me to think at what price it would be good value.

Praemium isn’t the only business that is growing strongly each year. The two ASX shares mentioned in the free report below are growing globally.

[ls_content_block id=”14947″ para=”paragraphs”]