Ethical Investment Week was running this week (15th –19th October) and it is an opportunity for Australians to learn more about investing in line with their ethics.

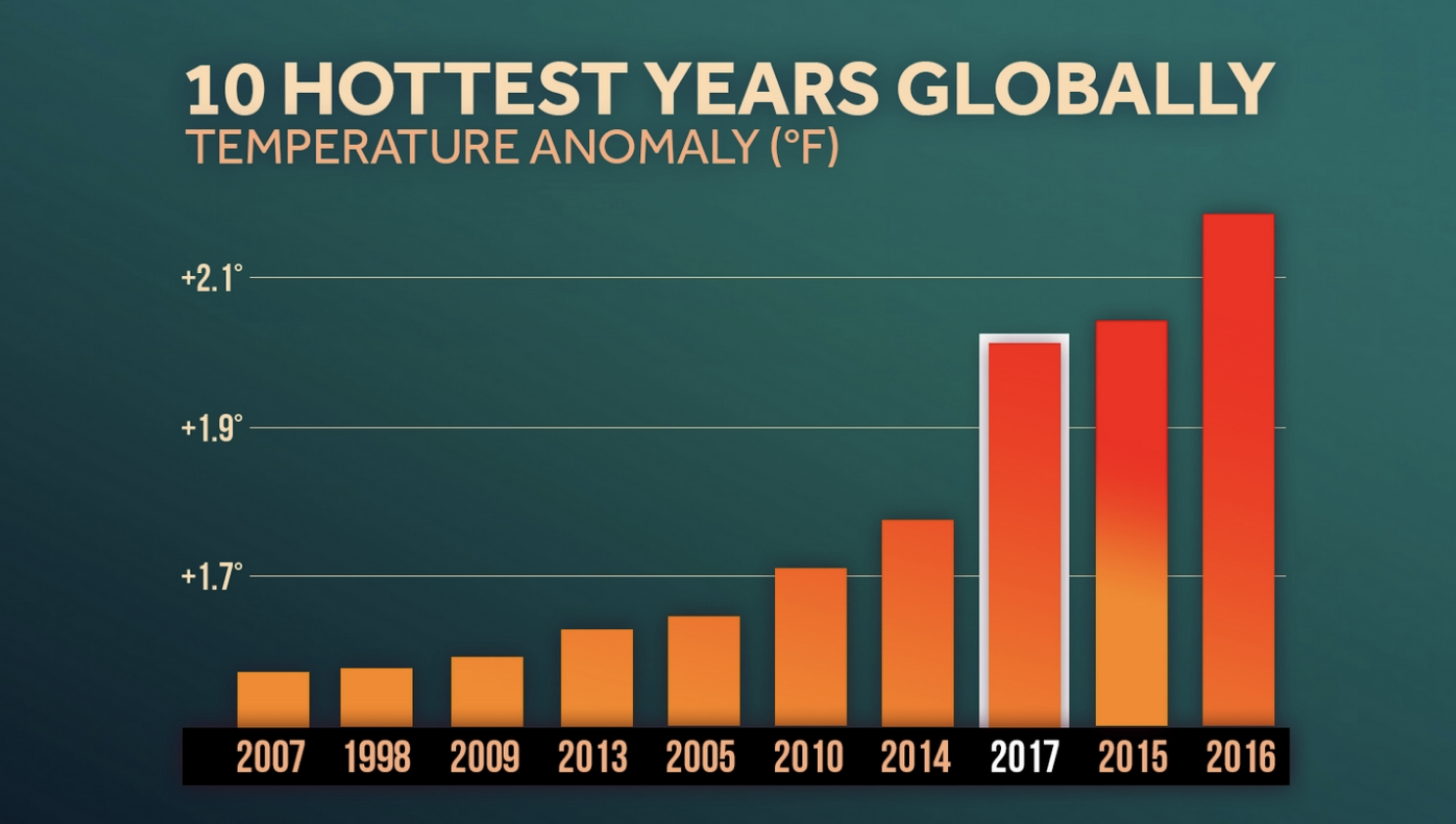

This year was as important as ever because the challenges have never been greater with the five hottest years on record all being this decade.

Figure 1 – Global temperature anomalies (°F) averaged and adjusted to early industrial baseline (1881-1910), as at January 2018

Source: NASA GISS & NOAA NCEI

There is a saying that “markets are made at the margin”: it means that it’s the incremental change that drives the direction of the stock market. If we look at the world today, the incremental change is in the direction of people wanting to change their prior behaviour and it is interesting to note that Mother Earth Day

this year is focussed on reducing plastics. We believe one way people can also have an impact is to align their investments with their personal beliefs.

Whilst some may argue capitalism is the root cause of the problem, we would argue capitalism offers the next step beyond civic action. The role of capitalism is to allocate capital to those businesses that are “better” and remove it from those that are “worse”.

By investing with managers who support the former, they can fund businesses that reduce emissions or biodegradable plastic alternatives. But people can also work to raise the cost of capital of the incumbent industries that are creating the problem. We argue it is the other leg of a sustainable strategy.

We run a Long/Short Hedge Fund that can short stocks that are harming the environment. We believe as more and more people change their behaviour, this will flow through to falling profits for these unsustainable businesses, thus our investors will have both made the world a better place and profited from it at the same time.

What Exactly Is ESG/SRI Investing?

Whilst there are many definitions and variations of what is broadly defined as “responsible investing”, there are two broad categories:

1. Socially Responsible Investing (SRI) or “ethical investing”

This is where investors require that their investments do not go into investments that are not in alignment with their own beliefs. This results in a list of stocks the investment manager is forbidden from buying and is often referred to as “negative screening”.

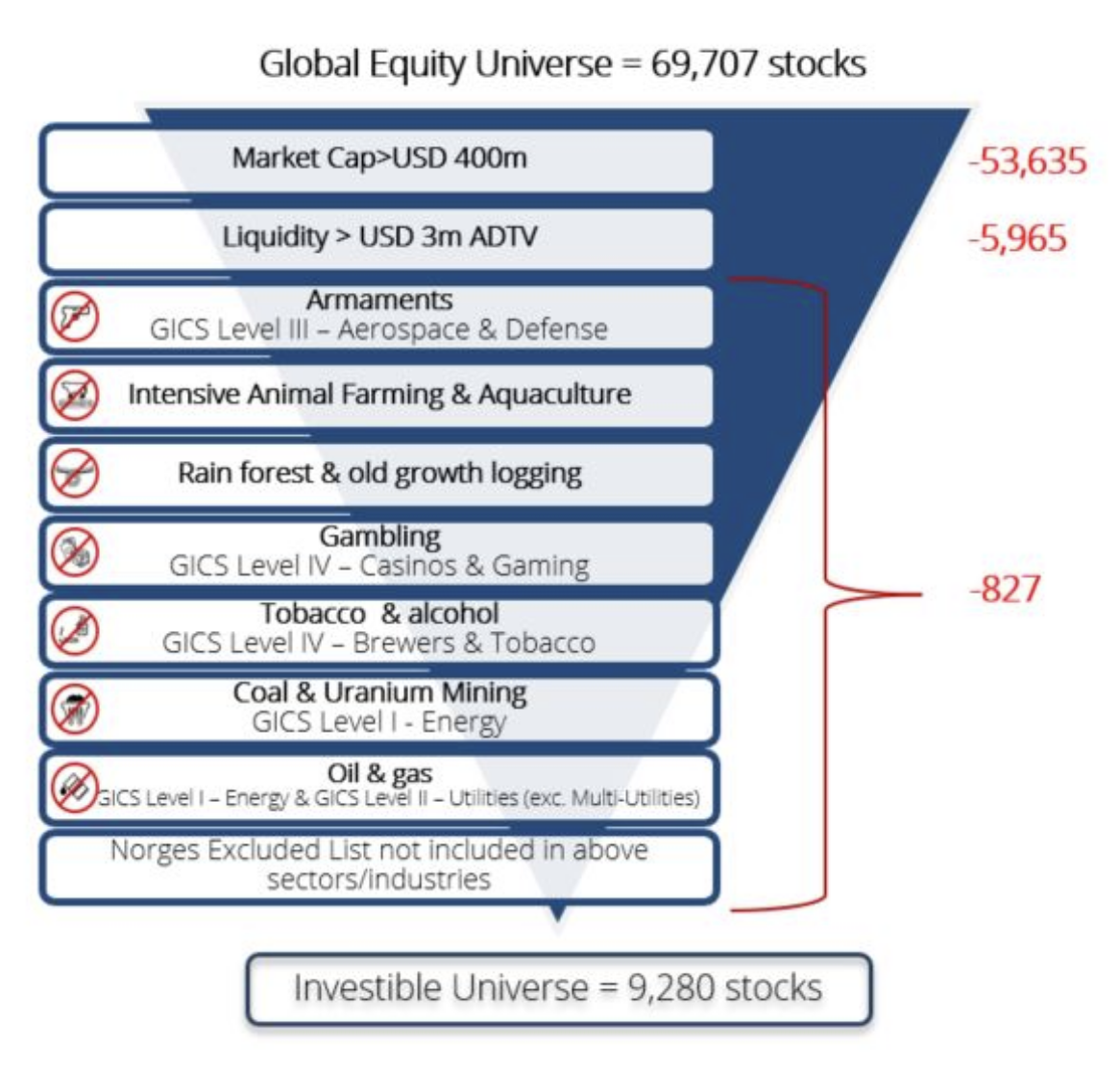

The types of stocks we exclude are listed below, with most ethically managed funds screening out variations of this list:

An interesting question that comes up often is: what is the investment universe after screening out those sectors?

In answering the first one, it will depend on the focus of each manager, but for us, it equates to approximately 900 stocks out of 9,000 names that we cannot invest in.

Source: Bloomberg, Team analysis; as at January 2018

Source: Bloomberg, Team analysis; as at January 2018

2. Environment, Social and Governance (ESG) Investing

Led by the Nordic region, the responsible investing community in the last ten years has moved beyond negative screening – although still incorporating it – to a what is current best practice: a holistic engagement focus.

Why? Because the negative screens only look at what a company does, it says nothing about how a company behaves. Facebook is a great and topical example. Whilst Facebook was never our type of stock and we never owned it outright, nearly every manager (and “ethical” ETF) who runs a simple negative screen model owns Facebook as it is a low-carbon emitting stock that is not in any of the above “sin categories”.

After the last few weeks, would you say Facebook behaves in what broader society would deem an ethical manner? We doubt it. ESG investing aims to examine a company’s impact on the environment; its impact on social outcomes (which may be women in the workforce or sweatshop clothes); and best practice in board governance.

ESG investing then seeks to engage with the company to try and work to improve parts of their business.

One could think of it as the idea that positive reinforcement and ownership will generate better outcomes for the world than just refusing to own the stock because of a categorisation.

We think Australia is still some way behind, based on my experiences with Scandinavian Asset owners who have been at the forefront of this movement. That said, the large pools of superannuation and readers who run SMSF’s can help push their managers in this direction – it’s your money after all!

But Does ESG and SRI Hurt Performance?

We often hear the claim that because “Sin stocks” have done well in the past years, therefore ESG cannot have added value if you excluded these stocks. Well, it happens to be a strawman argument that has been comprehensively refuted.

UBS recently published an excellent summary of recent academic literature looking at the question of whether SRI negatively affects investor returns. The conclusion was that it did not.

Verheyden, Eccles & Feiner (2016) wanted to look at whether a portfolio manager would be put at a disadvantage in terms of performance, risk and diversification if he/she were to start from a screen based on ESG criteria. The empirical evidence shows that all ESG-screened portfolios have performed very similarly to their respective underlying benchmarks, if not slightly outperforming them.

Put differently, the findings of the paper show that – at the very least – there is no performance penalty from screening out low ESG-scoring firms of each industry.

2 ESG Stocks In Focus: China Everbright & China Water Affairs To Clean Up China

The Morphic Funds added China Everbright International holdings late last year. From a fundamental perspective, it had many of the traits we look for in our investments: it was cheap (a P/E of approximately 10x); it was growing (EBITDA doubled from 2015 to this year); and the share price looked ripe to move higher.

We have blogged before about China Everbright Limited (HKG: 0165) – they are one of the largest “waste-to-energy” solution providers in China. They are paid to take garbage, which they sort and some of which ends up as an energy feedstock source. China’s fast growth of cities means that landfill is not a viable option any more. The focus of the government can be seen in the new 5-year plan that requires over 50% of municipal waste to be incinerated and not put in landfill by 2020.

Morphic feels the model of build-own-transfer (similar to the toll road model in Australia) is poorly understood by local Chinese investors and in the search for high growth stocks, this stock has been overlooked as “boring”. We value the stock at close to 50% higher than where it trades today.

Our second ESG stock is also focussed in China. China Water Affairs Group Ltd (HKG: 0855) (CWAG) is a $1.5bn USD Hong Kong-listed integrated water solutions supplier in China. The provision of safe drinking water to second-tier Chinese cities is another area of great opportunity. It’s difficult for non-Chinese companies to bid for the work and most municipal councils don’t have the expertise to upgrade the systems themselves.

CWAG is playing a key role in helping solve the looming water shortage issues China faces. National leakage is around 50% and with an expected shortage of 199bn cubic meters or 25% of demand by 2030, private operators, in this case, CWAG, whose average leakage rate is 16%, are a key solution to start to address the water shortage issue China faces. It shares many of the characteristics of China Everbright: it’s cheap, its growing and the price has started to respond to the news flow.

Interestingly, large Japanese conglomerate Orix owns almost 20% of the business and has a seat on the board of directors. This provides some comfort that our analysis and views are shared by a long-term investor.

With the stock having doubled since 2016, yet still tiny by Chinese standards, we see lots of room for future growth.

This article was contributed by Chad Slater, CFA, co-founder of Morphic Asset Management. Click here to be the first to read Morphic’s latest investing updates.

Disclaimer: This article contains general information only and should not be relied upon. The information does not take into account yours needs, goals or objectives. Therefore, you should consult a licensed and trusted financial adviser before you act on the information.