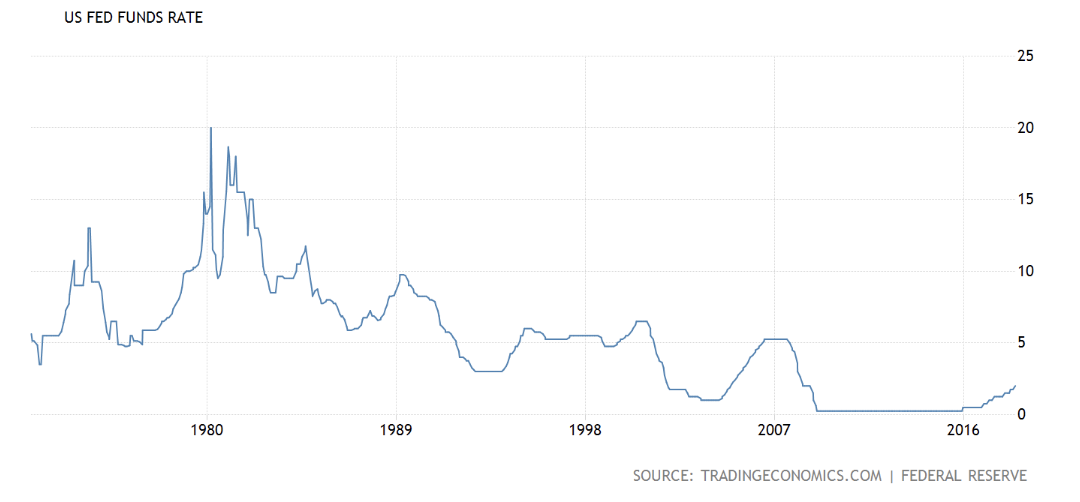

US interest rates

are on the rise, no-one is doubting it. Banks such as Commonwealth Bank of Australia (ASX: CBA) and Westpac Banking Corp (ASX: WBC) could be forced to raise interest rates.

US Rates On The Rise

Overnight, the Federal Reserve flagged higher interest rates in the world’s largest economy. As reported by Marketwatch, Federal Reserve Chairman Jerome Powell expects to raise US interest rates once every 3 months going forward.

“With a strong job market, inflation close to our objective, and the risks to the outlook roughly balanced, the FOMC believes that – for now – the best way forward is to keep gradually raising the federal funds rate,” Powell said to a US Senate Committee.

As can be seen above, US interest rates lingered at historic lows for many years following the Global Financial Crisis (GFC) of 2008/2009. A similar theme has played out in Australia — although our central bank, the RBA, has left interest rates at record lows.

Naturally, lower interest rates have made it much cheaper for households and businesses to use debt. With variable mortgage rates dropping below 4%, Aussies saw property as a great place to invest.

So what?

Official interest rate changes in Australia and the USA can have wide-sweeping consequences for the US and Australian sharemarkets, bond markets and even house prices here at home.

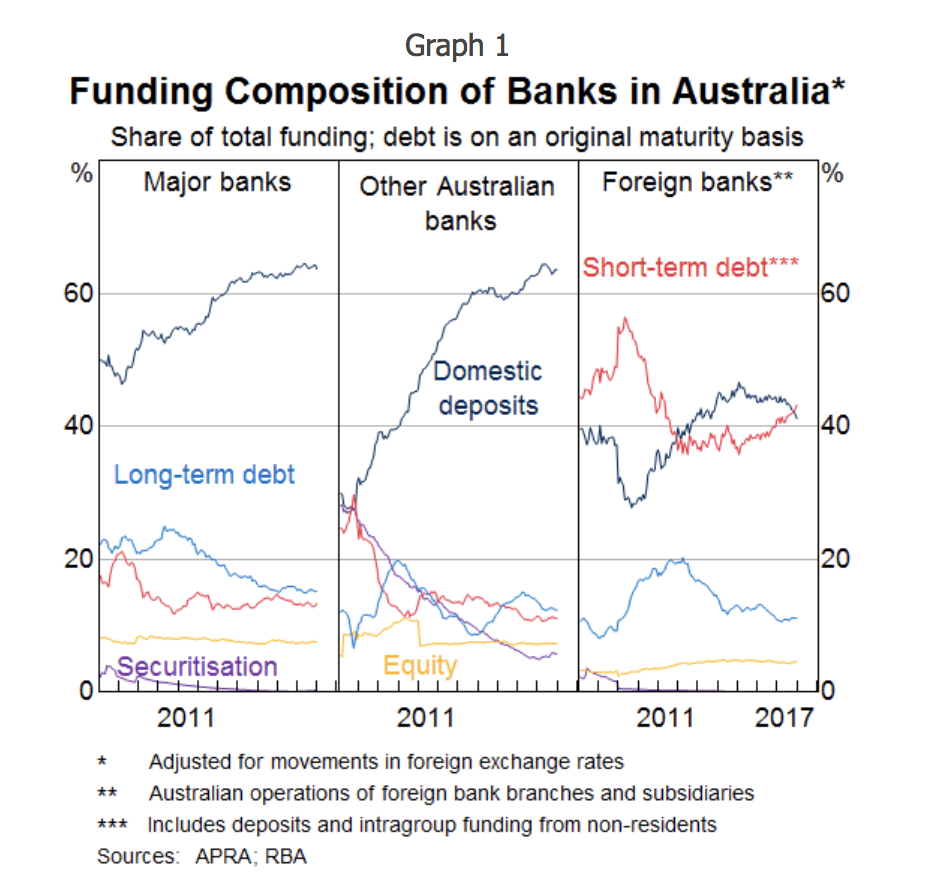

As we’ve seen in recent months, although Australia’s RBA hasn’t budged on local interest rates, rising US rates could lead to higher Australian mortgage interest rates because many of Australia’s largest banks rely on US debt markets to get a meaningful amount of their funding for loans. Meaning, the banks will be forced to increase mortgage interest rates or risk rapidly falling profits.

Source: RBA

As the RBA’s Tessa McKinnon wrote in March 2018: “The major banks obtain a larger share of funding from offshore wholesale markets compared with other Australian-owned banks.” The major banks include Australia’s two largest property lenders, Commonwealth Bank of Australia (ASX: CBA) and Westpac Banking Corp (ASX: WBC), as well as National Australia Bank Ltd. (ASX: NAB) and ANZ Banking Group (ASX: ANZ).

Throughout 2016 and 2017, many of the banks were able to keep their profit margins intact because rates for customer deposits were lower. “The decrease in the cost of deposits over 2017 has been driven in part by a decline in the average cost of term deposits, as term deposits that were contracted at higher rates in late 2016 have since been replaced with term deposits at lower rates,” McKinnon wrote.

Banks use your term deposits to fund their loans and make a profit from the difference between the two interest rates.

Therefore, if the competition for customer deposits intensifies and USA wholesale funding rates increase — and interest rates on mortgages do not increase — the banks’ profits are likely to be hurt.

That’s not likely to sit well with shareholders, which is why we’ve seen many banks increase their mortgage interest rates. And it’s one big reason I think interest rates on mortgages could go higher in the near future.

Homeowners set to lose?

As reported by the ABC, nearly one million Australian households could be ‘on the edge’ of default if interest rates rose just 0.15%. That’s less than one typical move in interest rates (0.25%).

Digital Analytics principal Martin North said, “Today 975,000 households across Australia with owner-occupier mortgages are right on the edge now.”

Talking about the banks, North said, “I’m almost certain they’ll be forced to lift those rates, it’s a question of timing, and of course the political reaction when it happens.”

So where does that leave property investors and homeowners?

With the prospect of fewer and more expensive loans on the horizon, I think more many Aussie homeowners and property investors will be feeling the pinch of slower house price growth and a tighter family budget.

If you haven’t already, now might be a perfect time to shop around for a good mortgage or call your bank for a better rate on your mortgage and term deposit.

Owen Raszkiewicz is the lead adviser of Rask Invest. Click here to download his free investing ebook.

Disclaimer: This article continues general information only and should not be relied upon. The information does not take into account your needs, risk profile or objectives. Please consider consulting a licensed and trusted professional before acting on the information. Please refer to The Rask Group’s financial services guide. Owen Raszkiewicz owns shares of Alphabet and Apple.