This morning Aerial imagery company Nearmap Ltd (ASX: NEA) updated the market on its progress in Australia and the United States.

Who is Nearmap?

Nearmap is a $255 million software business which specialises in providing regularly updated maps and images of targeted areas. Think Google Maps but clearer and more regularly updated.

Nearmap covers more than 70% of the United States and all of Australia’s major cities and areas. Insurers, construction companies and other businesses use Nearmap’s software to quote for solar panels and building insurance, check on building site progress and even monitor for illegal backyard pools.

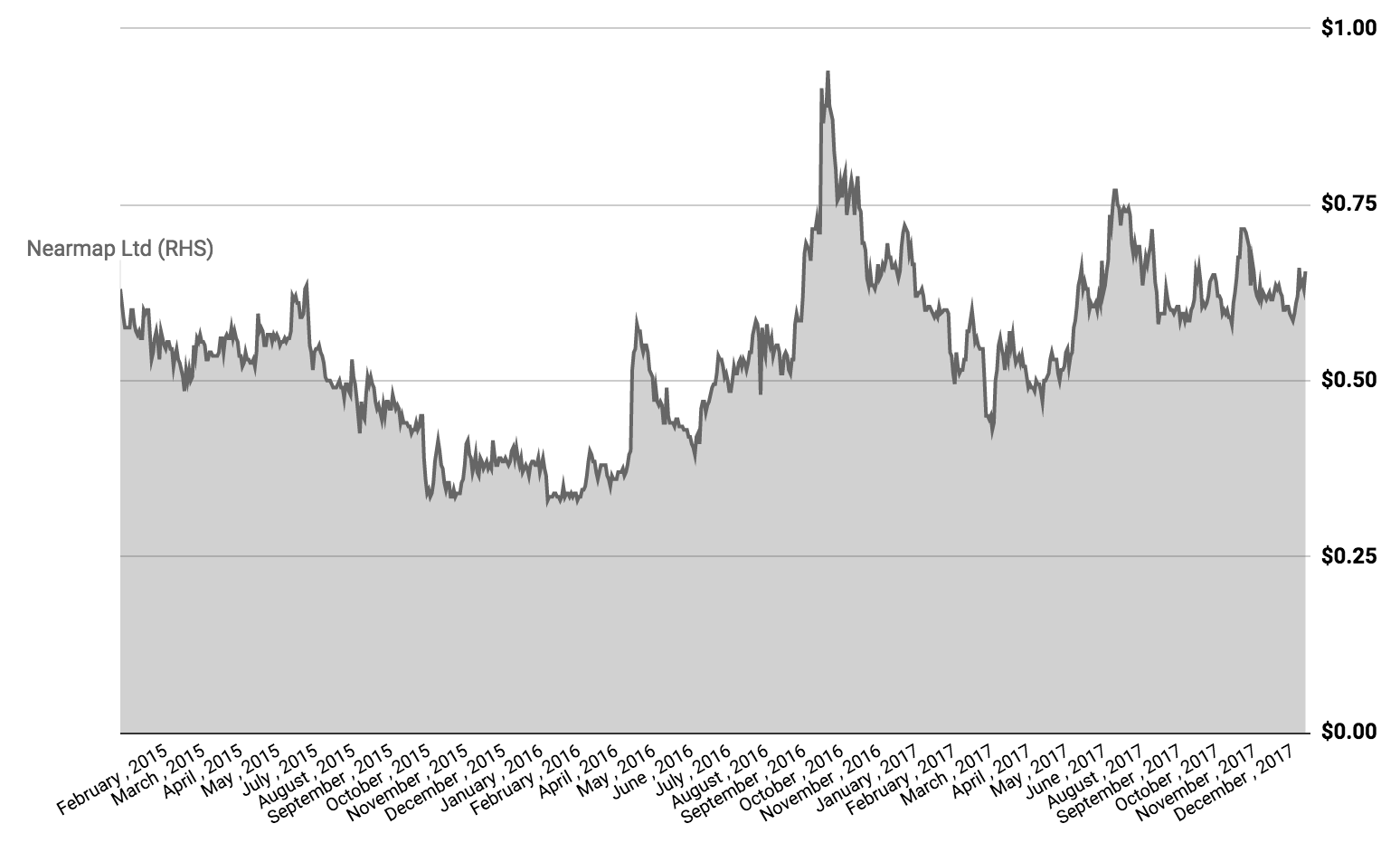

Nearmap Share Price

This morning, Nearmap released an update showing a 53% increase in ‘Annualised Contract Value’ (ACV) for the half-year period ended 31 December 2017, compared to the same period a year earlier.

In the United States, the company reported ACV of $US8.5 million, up from $US3.1 million. Australia remains the company’s largest geographic region for ACV at $43.3 million, up from $37 million.

Nearmap CEO, Dr Rob Newman, said, “Our Australian base of high quality, recurring subscription revenues continues to generate strong cash inflows, as we further build our sales and marketing expertise in the US.”

Nearmap recently announced the rollout of 3D imaging and processing technology for reconstructions. The HyperCamera 2 program is being undertaken throughout Australia and the US, with some customers already on trials.

“These products demonstrate our technology leadership and expertise and we look forward to ongoing strong growth,” Dr Newman added.

Nearmap will release its detailed results on February 21st.

Keep Reading