Are shares just gambling? Is the share market just a place for people with suits to gamble? If people cannot predict the short term movements of shares, it’s like gambling… right?

Similarities between the share market and gambling

First, let’s identify the similarities between the share market and gambling (pokies, lottery, casino, horse racing, etc.). The similarities between gambling and shares are as follows:

- Both involve numbers.

- Both have something to do with money.

- Both can seem unpredictable and confusing to beginners.

- Both attract a lot of guys wearing cringeworthy suits.

Okay, so far, so good.

But there’s a lot more to it than that. So let’s explore the key differences between shares and gambling.

7 reasons shares are not like gambling

Here are 7 reasons why they are very, very different…

- Investment vs. Speculation:

- Share Market: Investing in shares is about purchasing ownership in a company. If you buy Telstra (ASX: TLS) shares tomorrow you’ll get a tiny bit of its profit as dividends in a few months. In the share market, investors analyse a company’s performance, its potential for growth, and market conditions. The aim is to build wealth over the long term as the company grows and becomes more profitable. For example, if Telstra continues to grow its mobile network and outpace Optus, it might pay more dividends. Using over 150 years of US data, I found that big companies on the share market increase profits between 6% and 7% per year, on average. Over time, it’s a winner’s game.

- Gambling: Gambling involves betting on outcomes that are largely based on chance. The primary objective is immediate financial gain, with the understanding – and necessity – that the odds are against the punter. Why is necessary that the odds are against you? Think about it like this: if most people won their gamble, ‘the house’ would go broke in a day!

- Wealth Creation:

- Share Market: The share market has a historical record of wealth creation. Over long periods, diversified share investments tend to yield positive returns due to economic growth and company earnings (see above). Between 1900 and 2024, the Australian share market rose an average of 13% per year (including dividends and with 1-in-5 years going backward). That’s powerful. This happens because companies (and their people) find bigger and better ways to solve the world’s problems – hence why capitalism works (with bumper bars).

- Gambling: Gambling does not create wealth but redistributes existing money, often leading to net losses for the majority of participants.

- Information and Analysis:

- Share Market: Investors should use a variety of information sources and analytical tools to make informed decisions. Fundamental analysis in shares and index fund investing via ETFs, together with market trends, all contribute to helping us make educated investment choices.

- Gambling: While some gambling activities (like poker) may involve skill and strategy (keep in mind, you’re playing against other humans), many forms, such as pokies and lotteries, are purely luck-based with little-to-no information aiding the decision process.

- Risk Management (key point!):

- Share Market: Investors who are smart can employ risk management strategies such as diversification, hedging, or portfolio management to mitigate potential losses – while maintaining much of their upside.

- Gambling: In gambling, risk management is minimal and often involves setting betting limits. Crucially, doing this does not alter the odds of the game. It’s still a loser’s bet. You just use less money.

- Regulation and Oversight:

- Stock Market: The stock market is highly regulated by government bodies to ensure transparency, fairness, and protection for investors. This includes disclosure requirements, insider trading laws, and regular audits.

- Gambling: While gambling is also regulated, the focus is more on ensuring fair play and preventing fraud rather than protecting the financial interests of participants. At this very moment, the Australian government is trying to water down laws that were proposed in 2023 and, in my opinion, would protect kids and the general public from seeing gambling ads during live sporting events. Some might say that in finance, things like Contracts for Difference (CFDs) are gambling dressed up as investing. I agree. See my brutal comments about why I’d never use a broker like CMC Markets here. CFDs are a horrible example of mixing investing with gambling instincts.

- Time Horizon:

- Share Market: Investing in shares is typically a long-term endeavour. Studies will show that even for the thrill seeking high growth investors who buy individual stocks, it takes five years for the company’s financial performance to be reflected in the share price. Investors may hold shares for years or even decades, benefiting from compound interest and long-term growth.

- Gambling: Gambling outcomes are usually immediate, and the activities are short-term with no lasting financial benefit beyond the outcome of each bet. When you make a dud investment, you still own the stock (or ETF). That is, you own something. By contrast, when you take a punt that doesn’t work out, you immediately lose everything to the casino or sports betting app.

- Economic Contribution:

- Share Market: By investing in companies, you contribute to society. Your financial involvement provides the confidence and capital that allows innovation to happen, even if it’s not immediately apparent. If you weren’t helping customers solve a problem, the company would go out of business – hence why the best companies (Apple, Google, CSL, Microsoft, Commbank, etc.) tend to solve the most important problems for society (business connectivity, housing, blood transfusions, etc.).

- Gambling: Gambling primarily benefits the operators (casinos, bookmakers) and provides limited broader economic contributions compared to the stock market. Ironically, this is easily observable through a gambling company’s profit margins, which are published on the share market. That’s right! You can buy shares in many of the companies offering consumers the losing bet!

Sad facts about gambling

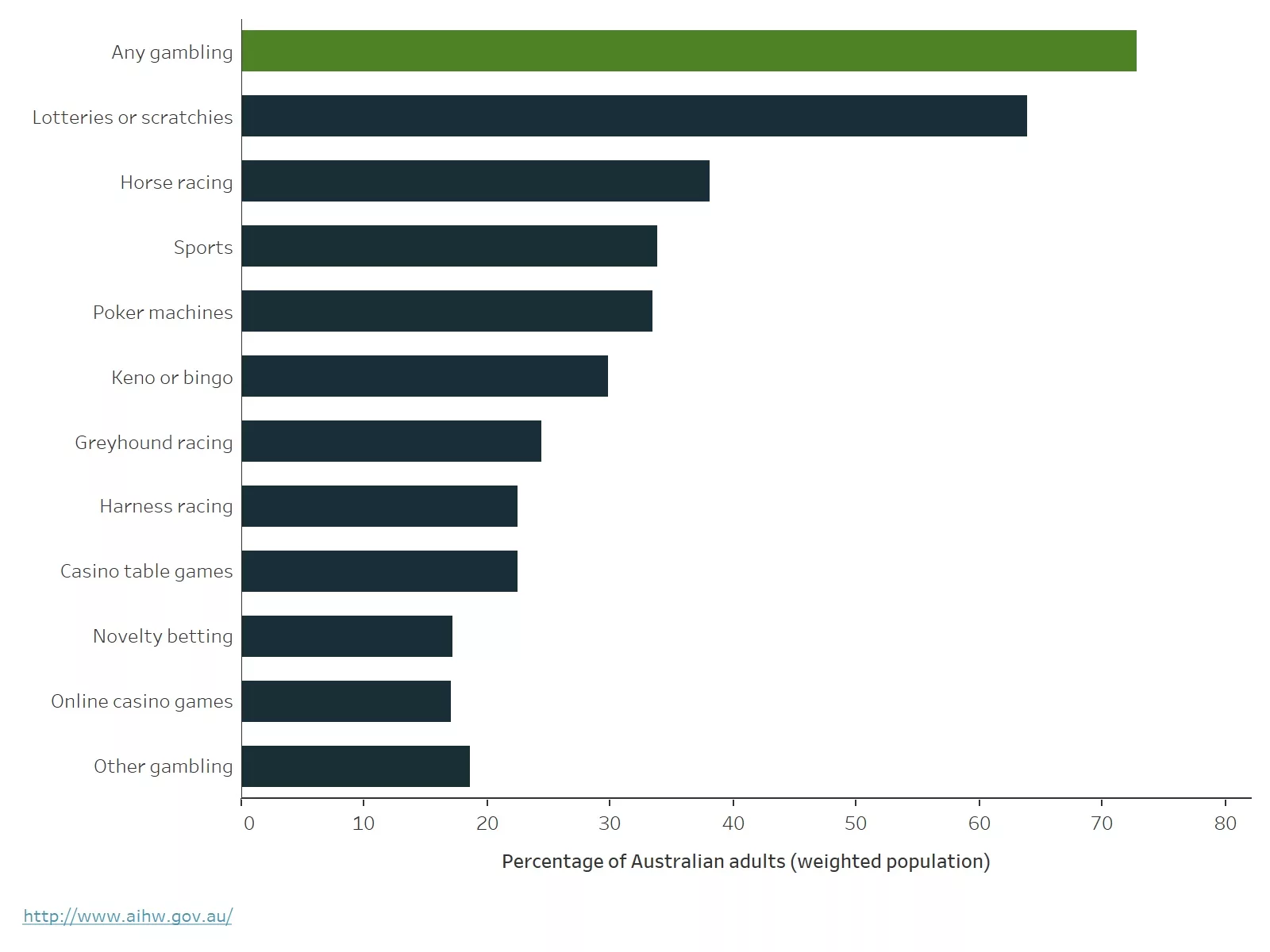

I’ll end with some sad facts about gambling in Australia, taken from the Government’s Institute of Health and Welfare:

- 72% of Australian adults gamble (~19 million)

- Men are much more likely to gamble (80% versus 66% for women)

- 46% of 18-19 year olds have gambled in the past year (this is incredibly sad)

- Australians lose over $25 billion per year (estimated to be as high as $1,500 per person – and many gamblers don’t have high incomes, so this is a huge chunk of their income)

Now that we know why investing is not like gambling.

Why investing is a wonderful thing to do with money (and for society).

And why we need to kick this silly idea that “investing is like gambling”.

Share this article with the person who says that to you…

And if you want to know how we approach investing, and how to avoid getting caught up in the stupid “stock trading” strategies that you see on Facebook (the ones that make investing seem like gambling), take a moment to read the Rask philosophy for investing.

Important point: Being addicted to gambling is a national tragedy, and it’s not your fault. Help is here. Use this link to get free and anonymous gambling support for you, a friend or a family member.