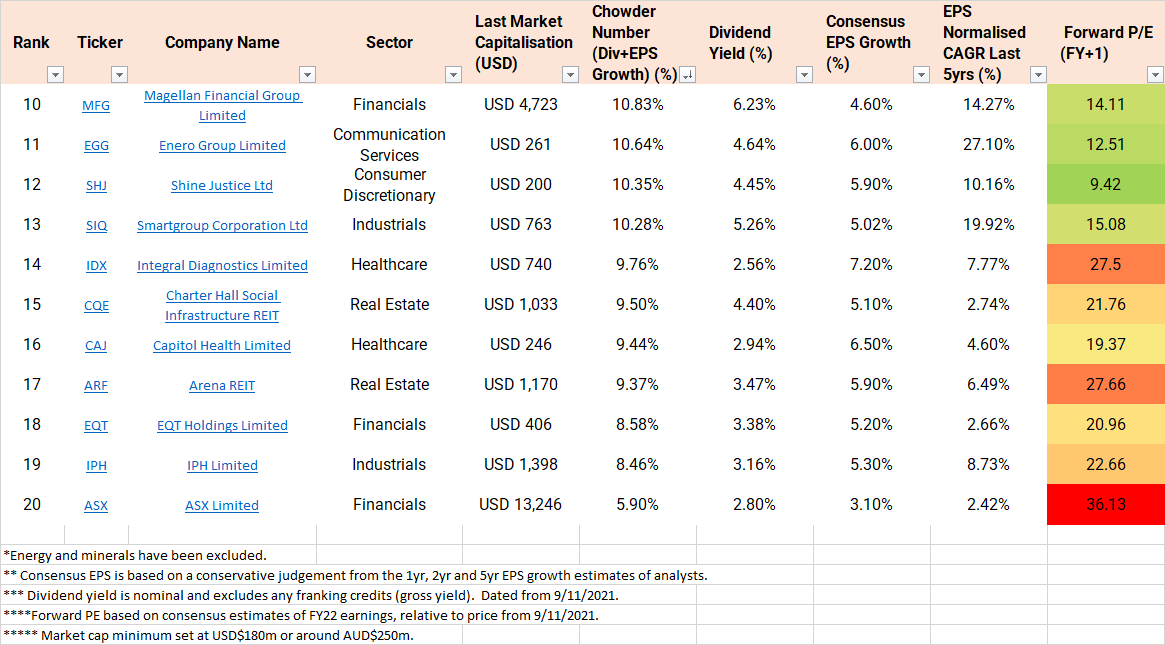

The Magellan Financial Group Ltd (ASX: MFG) share price has recently been trounced due to their funds’ underperformance. The yield has crept up to a whopping ~8.2% gross for what has been a very high-quality company. With slow to moderate growth forecast into the medium term, the Chowder Number of 10.83% puts Magellan in the top 10 dividend growth investments.

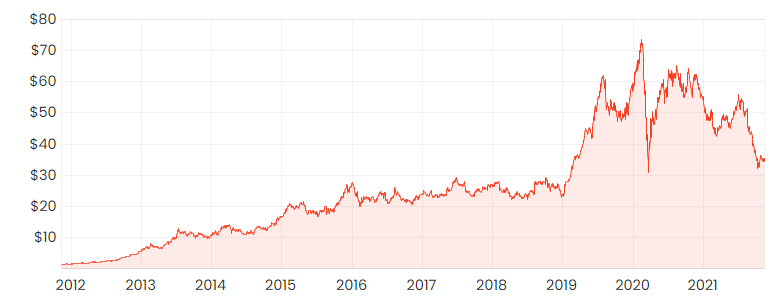

MFG share price

What does Magellan do?

Magellan is a fund manager that focuses on high quality long duration investments. Led by Hamish Douglass, a Buffet fanboi, the investment style is a mix between value and quality in the large cap space. With over $110bn of funds under management (FUM), the majority of revenues is derived from management fees and performance fees.

Magellan struggled during Covid with significant underperformance relative to its peers, such as GQG Partners (ASX: GQG). The main reasons for this include:

- It didn’t deploy enough capital at the March 2020 bottoms;

- Overly defensive with +20% in their infrastructure fund; and

- Overexposed to Chinese technology investments such as Alibaba (NYSE: BABA)

Without excusing the poor performance, it’s important to keep in perspective that Magellan seeks a 9% CAGR through the business cycle. They are defensive with lower drawdowns (around 45% compared to the index during corrections). This leads to underperformance on the way up, and theoretically over performance on the way down.

More recently, Magellan has started reinvesting in new businesses such as Barrenjoey and Guzman y Gomez. Known as Magellan Capital Partners (MCP), this part of the business required a significant amount of capital in FY21 and is not expected to provide immediate returns.

For more on this, you can see some thread’s I’ve written here and here, and some great articles from Lachlan here and here.

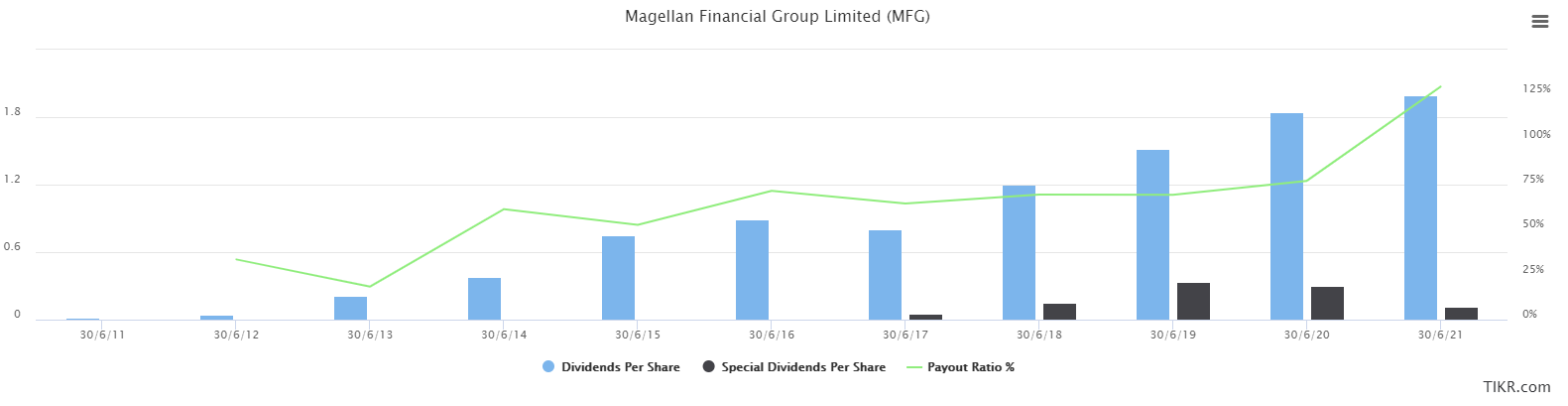

Magellan’s Dividends

Looking back over the past 10 years, you can see phenomenal dividend growth with reasonable payout ratios. The current yield is ~6.2% and 75% franked, providing a gross yield of ~8.2%. This has grown 19% CAGR over the past 5 years.

The special dividends marked in black above are related to their performance fees. It can easily be seen that FY21 had terrible results compared to FY19, related to the funds’ underperformance.

More recently, the payout ratio went above 100% in FY21 because of their capital investments in MCP. Removing that and focusing on cash flows, the payout ratio is ~80%. To my mind, the dividend safety remains strong despite a relatively high payout ratio of 70-80%. The nature of funds management with relatively low capital requirements means payout ratios typically are higher than other sectors.

Looking to forward returns

Forward returns are expected to be ~4.6% based on consensus. However, the dispersion of estimates is quite wide.

Some analysts believe Magellan will continue to lose FUM and management fees, while others believe the flows will remain flat in the near term. Furthermore, while performance fees dropped in FY21, some believe at least part of those fees will return later in the business cycle.

Finally, MCP remains an unknown and this is a significant strategic pivot from funds management to business ownership.

Valuations

The current price to earnings ratio (PE) of ~20 seems high, though again this is artificially high due to the MCP investments. The forward PE is closer to 15, which is widely regarded as ‘fair’ for a moderate funds management business. On this metric, it is slightly cheaper than the fast-growing GQG and above slow-growing Platinum Asset Management (ASX: PTM).

Risks

Despite a strong history of dividend growth performance and a decent valuation, the main risk is fund outflows from the funds management business. If funds outflows continue, and if margin/fees continue to be squeezed, then one could expect dividend cuts from FY23. This is definitely something to look out for.

Final thoughts

When quality becomes cheap, there’s often hairs on it. Magellan has been a stalwart, but is it able to turn things around? At current dividend yields, not much has to go right.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.