XRF Scientific Limited (ASX: XRF) is a specialist provider of equipment and consumables which are used in sample preparation for x-ray fluorescence spectrometry analysis. Basically, its technology is used to measure and analyse the purity of materials, mostly for quality control.

XRF’s business comprises of three divisions, which provide products for sample preparation, being:

- Capital Equipment: This division covers the sale and manufacturing of XRF’s Electric or Gas Fusion machines, Flux weighers and other lab equipment such as sample crushers, furnace/ovens and pressing/pellet machines. The bulk of sales are from XRF’s fusion machines which represent their core IP. A fusion machine converts a mix of the mineral sample and flux into a glass plate by melting the mix. The mineral sample is spread within the matrix of the glass compound allowing for the most accurate analysis in an XRF spectrometer. Capital equipment is made across both their Perth and Melbourne facilities.

- Consumables: This covers the chemicals consumed in the preparation of lab samples with XRF’s fusion machines. The main consumable product is Flux, which is a chemical that is fused with a mineral sample to ensure accurate spectrometry analysis. XRF also provides release agents (for cleaning and equipment maintenance) and reference materials (for machine calibration). Consumables are exclusively made at their Perth facility.

- Precious Metals: This covers platinum crucibles used in XRF preparation machines (new and refining), semi-finished products suitable for non-mining applications and with the investment into the Melbourne factory, customisable products. Precious Metals products are exclusively made at their Melbourne facility.

XRF’s Past & Present

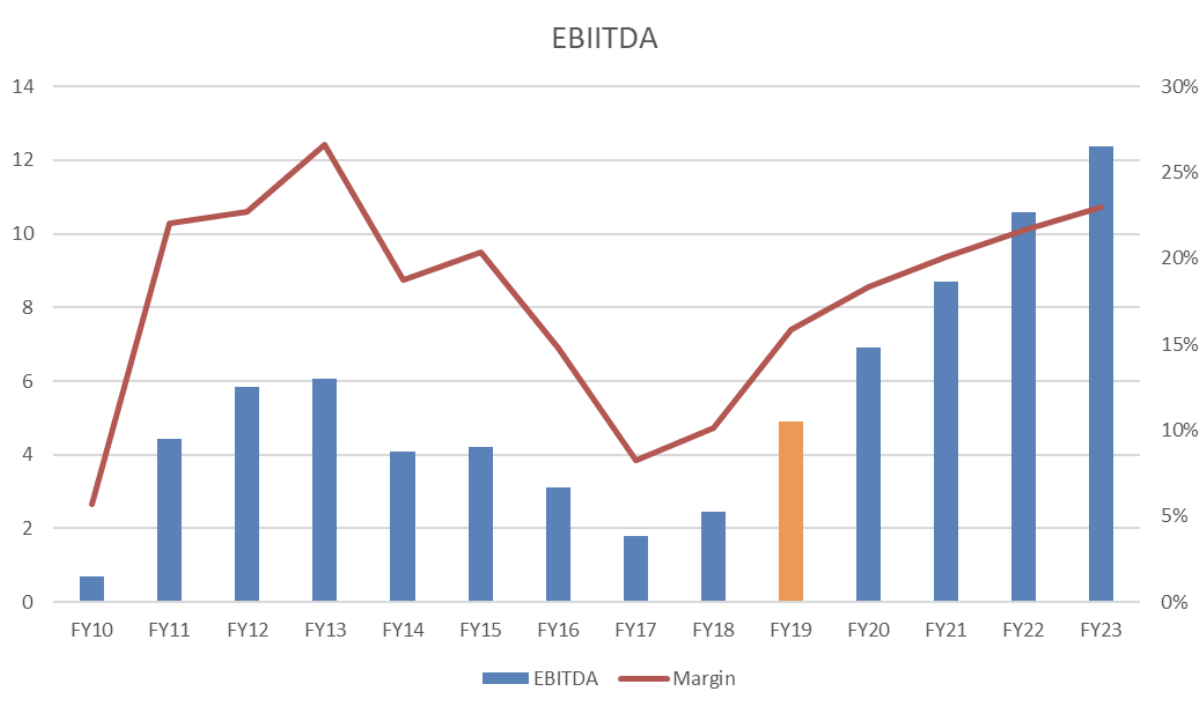

XRF listed in 2006 amongst the think of the pre-GFC part of the resources boom with its customer base heavily skewed towards the resource sector, particularly in commodities such as iron ore and nickel. From listing and to the peak of the resources boom in 2011/12, revenues grew from $6m to $25m whilst EBIT grew from $0.9m to ~$5.5m. Through this period, XRF made selected acquisitions which contributed to the growth. At the peak of the resource cycle, 95% of revenues were mining related.

Through the decline phase, which lasted from 2012 to 2016, revenues declined whilst margins also compressed across all three business divisions. Acquisitions made leading into this period as well as through this period, helped to cushion the revenue and margin decline as well as set up the business to reduce its exposure to the resources cycle. Further dampening margins towards the latter end of the cycle and through the early recovery phase between 2016 and 2018, XRF invested heavily to expand product range and manufacturing capability. I believe that this investment into the business provides a better long-term platform and sets the stage for increased revenue growth, broadening customer reach (geographic and product diversity) and margin reversion/expansion over the next 5 years.

XRF has a longstanding director and management team who are heavily invested in the business. They have also been disciplined in capital management, only raising equity twice (FY12 and 13) to support acquisitions and growth in the business, whilst since then all other investment initiatives and acquisitions have been self-funded. Salaries for directors is reasonable and senior management pay packets aren’t egregious by resource sector standards. In addition, little is given away in stock options/rights.

Shareholdings of insiders have come via stock in acquisitions or through on market purchases. I note directors have been net buyers over the second half of CY18 whilst other senior staff have been buyers. One of note is General Manager Jeff Brown who has bought most of his 1.5m+ shares on market over the last 2 years. Overall, a decent level of buying by insiders has been conducted at similar or higher prices than current (as the date of this thesis) through the heavy investment phase of the business. As such, I believe management is aligned with shareholders and are essentially rewarded through dividends and sustainable long-term share price growth.

The XRF Opportunity

The Resource Cycle

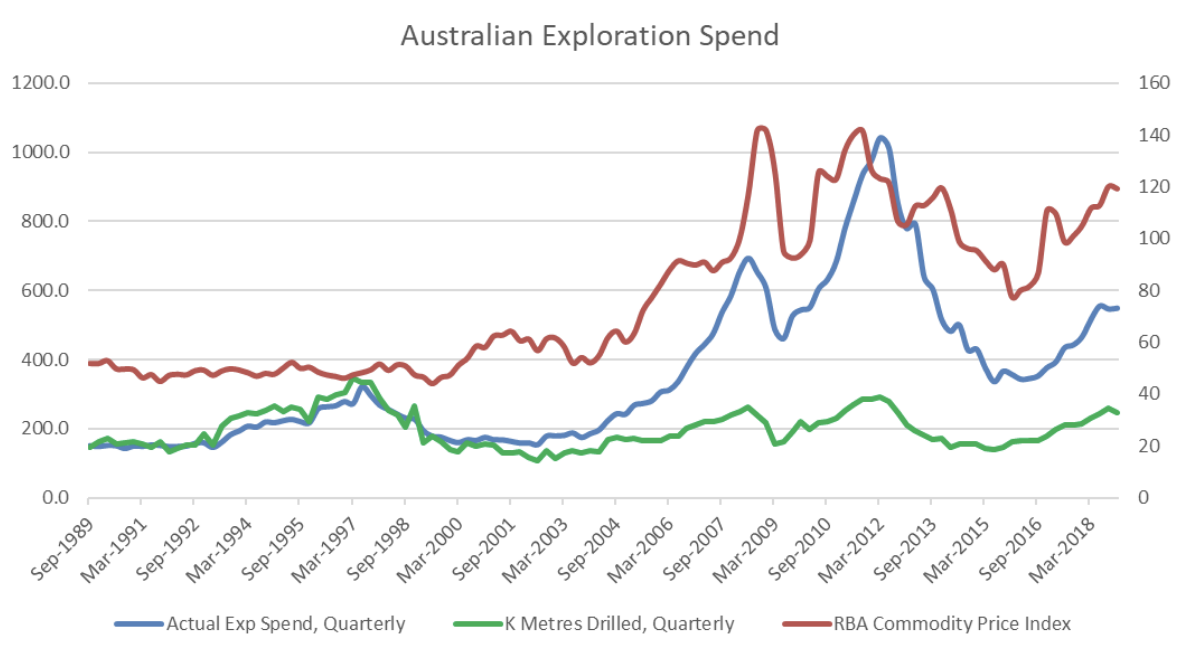

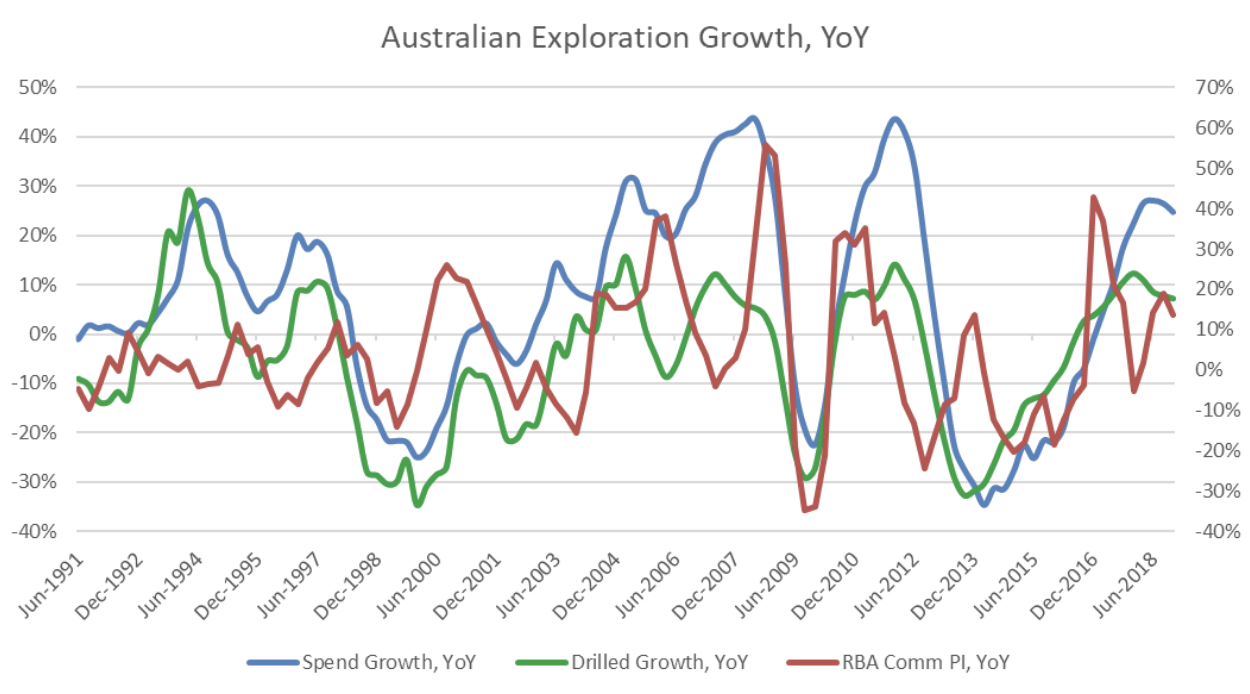

The first potential driver of revenue growth comes from the resources cycle, with the sector contributing around 60% of overall revenues. Within this, the best I can ascertain through discussions with management is that around 30% is still driven by the exploration cycle. With ~40% of overall revenues driven by production phase product quality testing (the relatively steady and growing base). The remaining ~20% of overall revenues driven by broader exploration spend, thus making it a material swing factor despite XRF diversifying is business over the last 7 years. Latest ABS stats show that domestically, with commodity prices trending up, exploration spend is following.

However, not all exploration spend is created equal as some methods are more expensive (i.e. diamond drilling). What is an equally important measure to look at is total metres drilled as well, which is also trending and growing in-line with commodity prices and exploration spending.

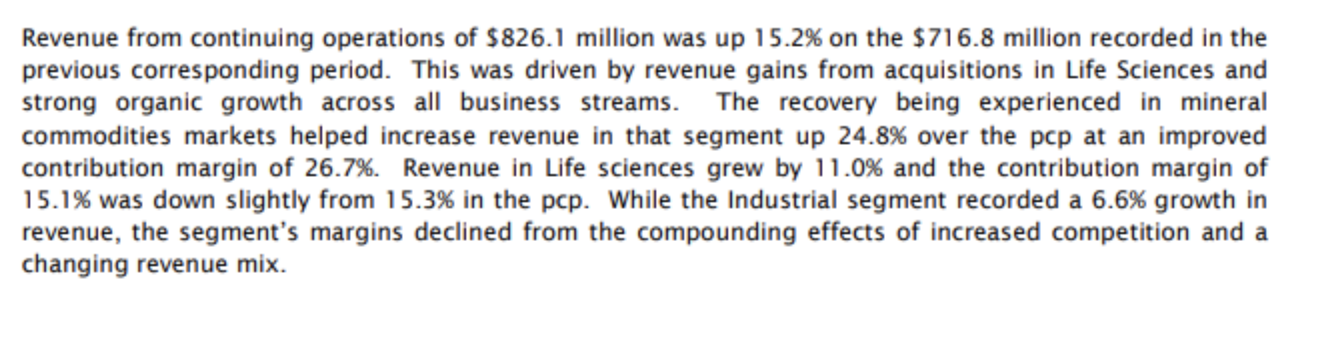

This increase and growth in activity is also evidenced by commentary in the reported results of XRF customers such as ALS who are seeing strong volume growth in their commodities business. In addition, they provide positive outlooks on higher sustained growth rates in this segment. Below is a snippet of ALS Ltd’s (ASX: ALS) half-year commentary dated November 2018.

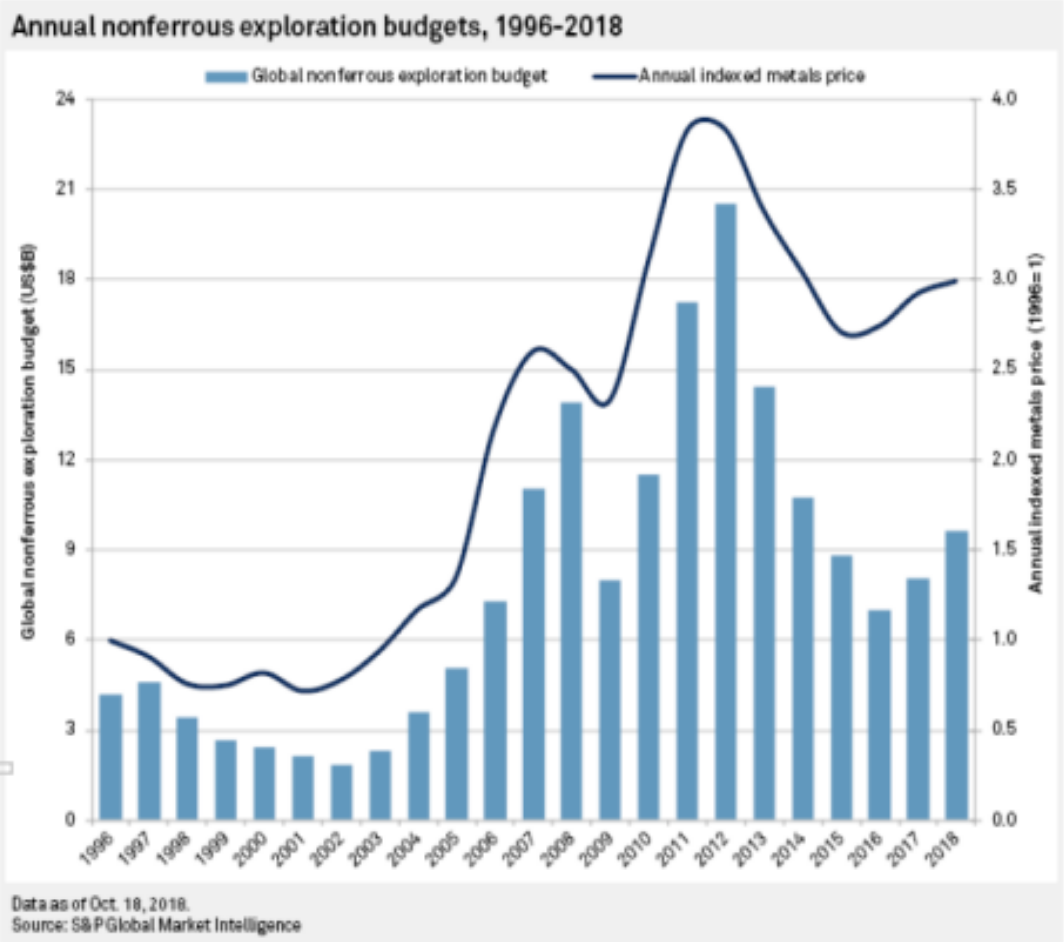

Globally, similar trends are being reported (as evidenced by PWC’s Mining Report Series, S&P Market Intelligence Reports) with exploration spend accelerating over the last few years, growing at around 15% and potentially accelerating, albeit coming off a cyclical trough as it is domestically. This provides a supportive backdrop for some of XRF’s global customer such as ALS, SGS and Bureau Veritas. The graph below is courtesy of ALS.

Product Development

XRF worked on a product refresh around three-to-five years ago in addition to new product initiatives. Some notable highlights include automatic electric fusion machines in 2013, the xrWeigh Carousel in FY16 and the Phoenix 2 in FY16/17. In late 2016, XRF added precision platinum products that aid in expansion into non-mining sectors, which are the focus of their EU business. For new or revamped products, it can take a few years of products being in the market and used by early adopting customers to build use cases or workflow adaptations from new features to drive sales in more conservative customers longer-term.

What this creates is the potential to grow market share with new, improved and leading products, whilst it also encourages a replacement cycle amongst existing customers. With a broad recovery in activity, revenue and profits amongst key customers, I believe this can manifest in increased capex expenditure (capex) that could benefit XRF as their customers look to add additional equipment at the margin to increase serviceability or upgrade equipment that has been run a little harder and longer through a low point in the resources cycle.

Other product initiatives within the Precious Metals division includes precision platinum ware and customisation. The precision produces includes semi-finished PGM products (foils, sheets, wires) suitable for non-mining applications, done alongside the EU expansion. With the heavy investment in the Melbourne factory, XRF can offer customised PGM products. These initiatives broaden the potential customer base and allow XRF to offer better overall service levels to their customers.

I also believe that a refreshed and expanded product set with prove usage supports XRF’s growth initiatives in new markets and segments, with the most value add with cross-sales into the expanded European business, which has predominately focused on selling PM division products.

Although historically lumpy, I believe 1H19 sales are indicative of the above views as capital sales posted a strong result, which was a combination of replacement machines (xrFuse 6) and new product initiatives (Phoenix GO S). I note that with the 2016 releases of the xrWeigh Carousel and Phoenix 2, XRF saw 2H16 and 1H17 capital sales growth elevated over these periods.

Investment in the Business (Acquisitions and Capex)

As noted earlier, XRF has made periodic acquisitions, with a focus on using them to expand their geographic footprint. The acquisitions of Socachim and Scancia provided XRF with established customer and distribution channels to work through and leverage off. I note that Socachim was a big EU distributor of XRF products already and I believe that by making this acquisition, alongside the other EU centric ones, this would allow XRF to own these channels and networks that they can leverage to diversify the business and accelerate sales growth across the product suite.

The other side to this part of the story is an investment in the business. Through 2015 to 2018, XRF invested across the business, with the most notable efforts being an expansion of the EU business into Germany and a complete rebuild of their manufacturing capability in Melbourne (higher capacity, process automation and ability to make customised products). I estimate that XRF funded (via cash flow and debt) $4 million to $5 million in upfront capex, working capital and initial operating losses, which I consider impressive for a sub $30 million business. Especially considering it was done during a low point in the cycle for revenue growth, margins and cash flow.

Early in the Margin Reversion Story

With the bulk of the acquisition and investment spending behind, XRF can focus on taking advantage of the operating leverage in the business model as sales accelerate. Phase 1 of margin expansion that XRF is showing currently is rolling off the expensed investment costs and losses associated with supporting the EU expansion (I note the German office is now profitable and a net contributor to margins) and Melbourne factory upgrade. Phase 2 comes from leveraging the sales and manufacturing platform in which incremental sales will flow through to the bottom line driving higher margins. Phase 1 is likely to play out over the course of FY19, in which I expect overall margins to around the mid-teens, whilst over the next 3 to 5 years, I expect margins to revert closer to prior peak levels in the low to mid 20% range.

With the margin recovery comes strong growth in earnings and return on equity. Historically, the share price and valuation of XRF has been correlated to ROE, thus as margins and profits revert to longer-term highs, I believe this will support a re-rating in the share price.

Risks

As XRF is a very small company, there are many risks to consider before investing. Some of them I have listed below:

- Global recession risk. Any sustained economic slowdown or recession globally could de-rail the resource recovery leg as falling demand will crimp prices and put volumes at risk should it persist long enough for supply to be taken out of commodity markets. Lower price, volume and profit environment for miners would also feed through to exploration spend. For XRF, this would directly impact consumables as lower volumes and metres drilled means less flux demand, whilst at the second derivative level, it would put off capital sales as well.

- Execution risk. Whilst the German office has just turned profitable and the backend of the business has been optimised to support a bigger operation feeding a more diverse customer base, there remain long-term execution risk to justify product expansion into new segments (i.e. precision PGM products) and investment spend (i.e. optimally utilise capacity). Whilst initial signs appear promising, it can take a longer-term and focused effort to sustain and grow sales in new verticals organically to take market share in existing markets. Failure here would temper the margin reversion/expansion potential.

- Threats from new tech/tools. There is always a threat that new technology could replace XRF spectrometry or a competitor could emerge with a better fusion device. However, validation takes time, as does convincing lab analysts to take it up en masse. Particularly if a methodology such as XRF spectrometry is considered a leading standard. As such, any new tech would take a long time to slowly eat away at XRF’s business. Even with the growth in the use of hand-held XRF devices, this has not displaced the need for lab XRF analysis as is typically complementary in directing and optimising exploration on the ground. Whilst if successful in finding a resource, lab-quality assays would be needed to generate a credible resource estimate under various resource codes.

- Input cost risk. Lithium prices and the Australian Dollar (AUD) are key sensitivities into the consumable business. Lithium prices have moderated as an oversupply has emerged in that is expected to persist in the mid-term. However, given the moving parts and potential for over-optimistic assumptions on supply, there is a risk that lithium prices could find a base and move higher sooner than currently expected which would become a headwind to consumable margins. The AUD is also an issue as materials and components are imported to produce products in Perth and Melbourne. For the PGM business, given the pricing mechanism used by XRF, platinum price risk is borne by the consumer thus negating input price risk for this division. Given pricing and supply for all products is out of Australia, a lower AUD could improve the relative price competitiveness of XRF in which case there the potential for volumes to offset margin compression (a game of relative deltas) and mitigate the overall headwind to profit growth.

Valuation

Based on my forecasts, XRF trades on an FY19 EV/EBITDA multiple of ~4.5x, which is towards the low end of the range for mining services and similar business. However, given the specialised nature of the products and services provided, coupled with the revenue/profit growth above the median of the peer group, leading margins and more diversified customer base; I believe XRF should trade at a multiple towards the top end of the peer group which is around 8x. If this is not a favoured valuation metric, using PE, EV/FCF and Dividend yield metrics also suggest that XRF is undervalued by a similarly materially amount.

All in all, with the potential for accelerating revenues growth and reversion in margins, I believe the current valuation offers investors with a margin of safety and strong positive asymmetry in return outcomes.

Another microcap in this space that offers a reasonable analogy is LaserBond Limited (ASX: LBL). LaserBond spent years investing in its business, sales, products, etc… as well as getting through the long lead time it takes to validate products/services and allow their target market within the resources/industrial sectors to use them.

LaserBond recently hit an inflection late last year after all the investment (cost) began to show through to higher sales. LaserBond’s sales are now rising across the board from both new/existing customers locally and in the US, as well as tech licencing with a UK engineering firm. The EBITDA multiple prior to this inflection was a little under 4x which was too cheap for similar companies within the sector. A re-rating was driven as investors could see higher and accelerating long-term revenue growth potential emerging with a business that is positioned to scale (i.e. margin expansion). A key difference is that XRF has a better history or how the business looks under various trading conditions and investment initiatives (re-emerging story), whereas LaserBond was more about finally benefiting from years of investing and work (emerging story).

[ls_content_block id=”14948″ para=”paragraphs”]

Rask Editor’s Note: Though XRF Scientific seems to be impressive, it is a very small and illiquid company, and like all companies, it has an uncertain future. Therefore, we believe an investment in XRFs shares should be considered high risk.

At the time of publishing, Joshua owns shares of XRF Scientific Limited.